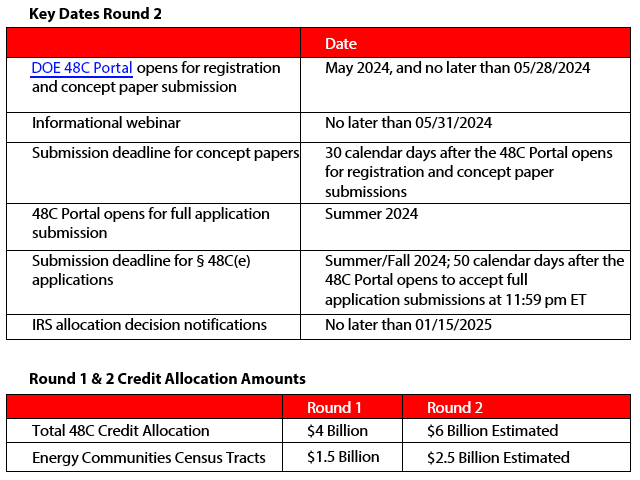

On April 29, 2024, the IRS and Treasury Department announced the procedures for the second round of federal tax credit allocations for the Advanced Energy Project Credit Program (48C Program) under Internal Revenue Code Section 48C(e) in Notice 2024-36. The announcement includes modified Appendix A – Eligibility, Appendix B – DOE Application Process, and Appendix C - 48C(e) Energy Communities, which contain guidance for the Program. Revisions to the Appendices include further clarification and examples of types of property that are eligible or ineligible for the Program. The revisions also include renaming the "Greenhouse Gas Emission Reduction Projects" category from Round 1 to "Industrial Decarbonization Projects" for Round 2 and clarify that eligibility under the program category remains unchanged from Round 1. The other categories include clean energy manufacturing and recycling projects and critical material projects. Treasury and the IRS will determine after Round 2 if an additional allocation round is needed, and clarified that failure to receive an allocation in Round 1 does not prevent an applicant from applying in Round 2.