On October 7, 2020, the Securities and Exchange Commission (SEC) proposed an exemptive order which would permit “finders” (i.e., natural persons engaged by issuers) to solicit accredited investors in connection with private securities offerings and receive transaction-based compensation for doing so, without first having to register as brokers under the Securities Exchange Act of 1934 (the “Exchange Act”).[1]

The bedrock of the American entrepreneurial economy has long been small businesses and startup ventures, fostered in large part by the opportunities available to such startups to raise capital. One of the ways small businesses often seek to raise capital is through private securities offerings made in reliance on exemptions from registration under the Securities Act of 1933, as amended (Securities Act). However, capital raises can prove difficult when businesses and business owners lack, or are located in areas that lack, robust capital raising networks. In this regard, intermediaries with access to such networks can be instrumental in bridging the gap between small businesses that need capital and investors who are interested in supporting emerging enterprises. Historically, the patchwork of rules and regulations and inconsistency of enforcement by regulatory authorities has created uncertainty for such intermediaries who are not registered as brokers.

The SEC has not previously recognized a “finders” exemption or exception or broadly addressed whether and under what circumstances a person may “find” or solicit potential investors on behalf of an issuer without being required to register as a broker[2]. Instead, issuers and market participants have often looked to narrowly tailored “no-action”[3] letters for guidance on how to distinguish between “finder” and “broker” activities.

The SEC’s proposal, if adopted, will set forth clear guidance on this issue, expressly permitting natural persons to engage in certain solicitation of accredited investors, and receive transaction-based compensation for the same, without first having to register as brokers. Specifically, the proposal would create two classes of finders: Tier I Finders and Tier II Finders, with each being subject to conditions tailored to the scope of the respective activities permitted for such finders.

Tier I Finders

Under the proposed exemption, a Tier I Finder would:

(i) be limited to providing contact information of potential investors in connection with only a single capital raising transaction by a single issuer in 12-month period; but

(ii) be unable to have any contact with potential investors about the issuer.

The activities of Tier I Finders would be restricted as described so as to prevent the participation in continuous or multiple sales of securities by persons that are not subject to broker registration or the heightened requirements applicable to Tier II Finders.

Tier II Finders

A Tier II Finder may solicit[4] investors on behalf of an issuer but is limited to:

(i) identifying, screening, and contacting potential investors;

(ii) distributing the issuer’s offering materials;

(iii) discussing issuer information included in any offering materials (but without advising on valuation or advisability of the investment); and

(iv) arranging or participating in meetings with the issuer and investor.

Given the unrestricted number of capital raises and issuers with respect to which a Tier II Finder would be able to act as a solicitor, a Tier II Finder would also be required to provide disclosures to investors describing the finder’s role and compensation prior to or at the time of the solicitation and obtain a dated written acknowledgement of receipt of the required disclosures from each investor.[5] The disclosures must include:

(i) the name of the Tier II Finder;

(ii) the name of the issuer;

(iii) the description of the relationship between the Tier II Finder and the issuer, including any affiliation;

(iv) a statement that the Tier II Finder will be compensated for his or her solicitation activities by the issuer and a description of the terms of such compensation arrangement;

(v) any material conflicts of interest resulting from the arrangement or relationship between the Tier II Finder and the issuer; and

(vi) an affirmative statement that the Tier II Finder is acting as an agent of the issuer, is not acting as an associated person of a broker-dealer, and is not undertaking a role to act in the investor’s best interest.

Additional Requirements for Both Tier I and Tier II Finders

In addition, the proposed exemption for Tier I and Tier II Finders would be available only where:

(i) the issuer is not required to file reports under Section 13 or Section 15(d) of the Exchange Act;

(ii) the issuer is seeking to conduct the securities offering in reliance on an applicable exemption from registration under the Securities Act[6];

(iii) the Finder does not engage in general solicitation;

(iv) the potential investor is an “accredited investor” as defined in Rule 501 of Regulation D[7] or the Finder has a reasonable belief that the potential investor is an “accredited investor”;

(v) the Finder provides services pursuant to a written agreement with the issuer that includes a description of the services provided and associated compensation;

(vi) the Finder is not an associated person of a broker-dealer; and

(vii) the Finder is not subject to statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act, at the time of his or her participation.

Finders complying with the conditions and requirements set forth in the exemptive order would be permitted to receive transaction-based compensation for the limited services he or she provides to issuers without being required to register as brokers pursuant to Section 15(a) of the Exchange Act.

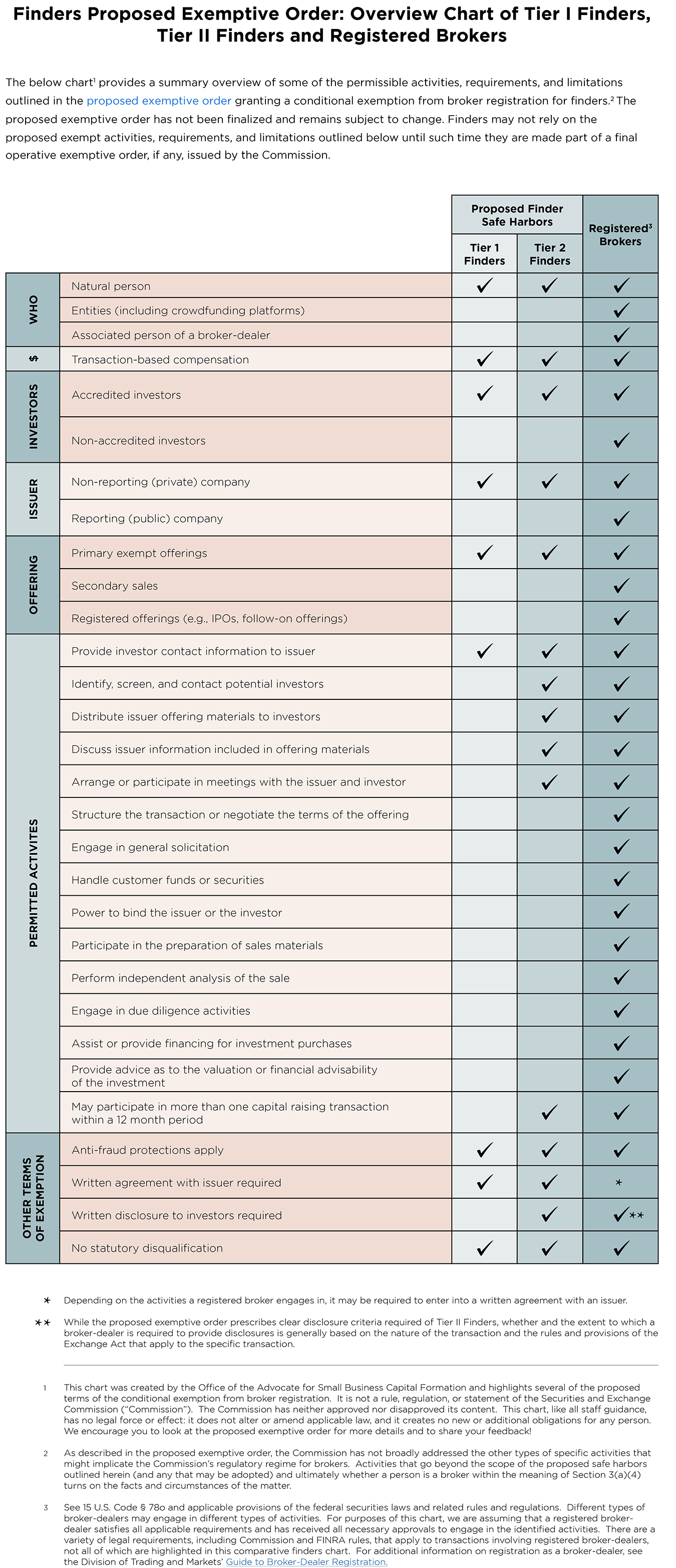

The SEC has provided a helpful chart (available here and reproduced below) summarizing the permissible activities under the exemptive order with respect to both Tier I and Tier II Finders and comparing these activities to those of registered broker-dealers.