Key Takeaways

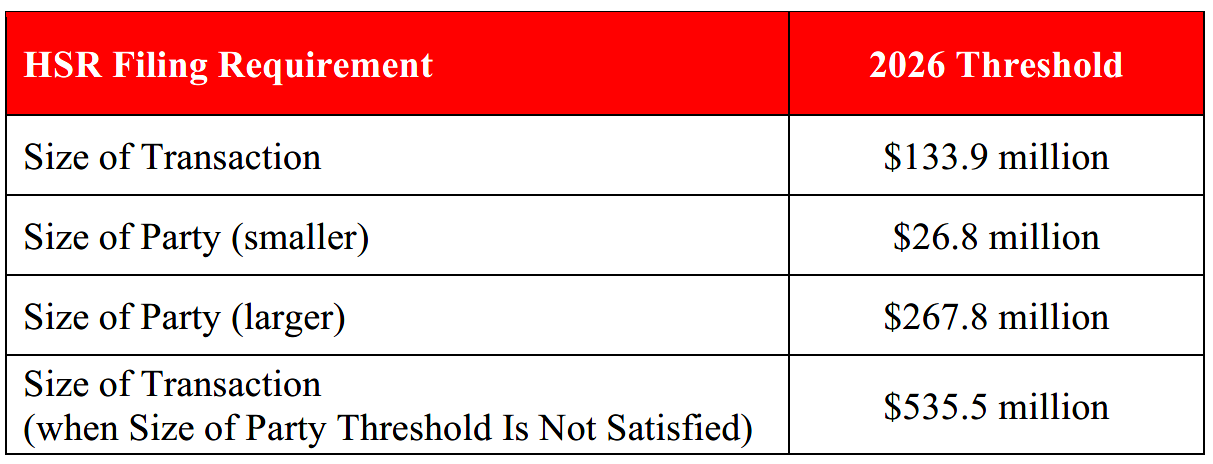

- The 2026 adjusted HSR threshold will increase to $133.9 million. All transactions valued below that amount will be exempt from the HSR filing requirement.

- The 2026 adjusted Size of Party thresholds for transactions valued below $535.5 million are $26.8 million and $267.8 million.

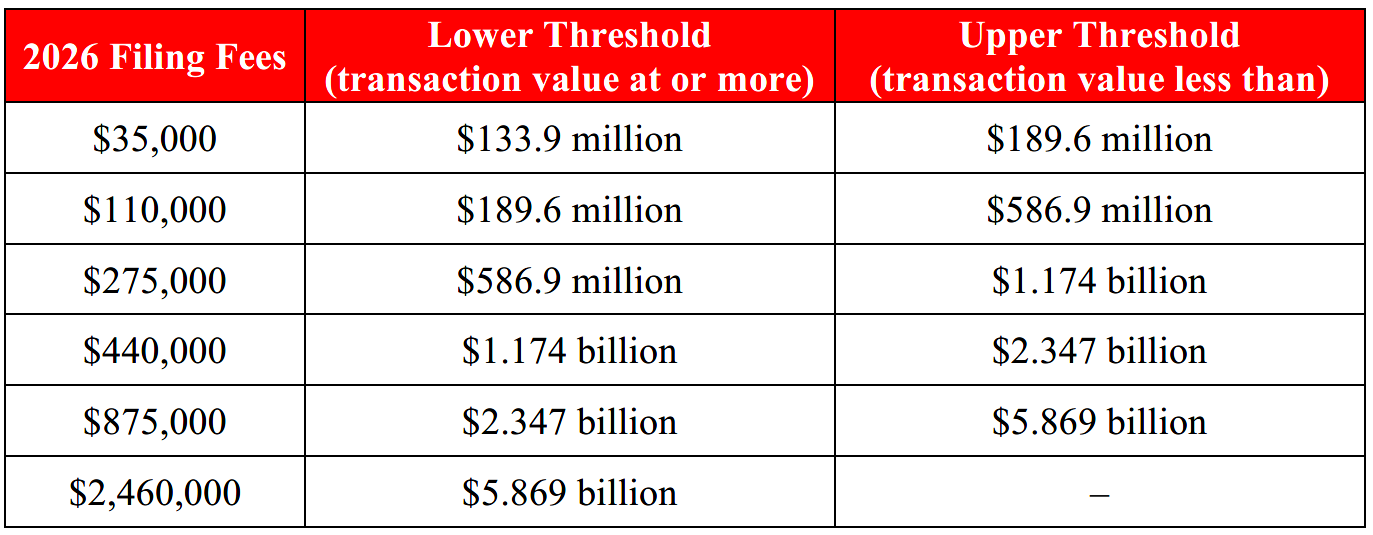

- The HSR filing fee schedule was also updated, and the lowest fee will now be $35,000.

- The new thresholds go into effect for transactions closing on or after February 17, 2026.

* * *

The Federal Trade Commission (FTC) has announced its annual adjustment to the thresholds for pre-merger notification filings under the Hart‐Scott‐Rodino Antitrust Improvements Act of 1976 (HSR). The adjustments account for changes in the U.S. gross national product. The FTC also announced increases in the HSR filing fee schedule and the thresholds for interlocking directorates under Section 8 of the Clayton Act.

HSR Act Thresholds

The HSR Act requires entities contemplating mergers or acquisitions of voting securities, non-corporate interests, or assets that meet or exceed certain monetary thresholds to file pre-merger notification forms with the FTC and the U.S. Department of Justice (DOJ) and to wait a designated period of time (typically 30 days) before consummating the contemplated transaction. The key thresholds are summarized below:

HSR Filing Fees

The FTC also revised the HSR filing fee schedule based on changes to the U.S. gross national product and the consumer price index. The 2026 filing fee schedule is follows:

The regulations governing the methodology for calculating the size of party and the size of transaction tests, as well as exemptions from the HSR Act, remain unchanged.

Interlocking Directorates Safe Harbor

In addition, the FTC revised the Section 8 thresholds, which prohibit a person from serving as a director or officer of two competing corporations (known as an interlocking directorate or an interlock). The prohibition is now triggered if each corporation has capital, surplus, and undivided profits aggregating more than $54,402,000 and each corporation’s competitive sales are at least $5,440,200, unless an exception applies.

* * *

All of the revised thresholds will remain in effect until the next adjustment issued by the FTC, which generally occurs in the first quarter of each year.

It is important to keep in mind that transactions do not escape antitrust scrutiny simply because the HSR Act’s thresholds are not satisfied or because the HSR waiting period has expired. Indeed, the FTC and the DOJ regularly file suits seeking to unwind previously consummated mergers and regularly investigate small transactions with purchase prices well below the HSR thresholds, in situations where they believe the transactions are anticompetitive.

* * *

If you have questions about this or any other antitrust matter, please contact Corporate Partner Austin A.B. Ownbey at (202) 824-1734 or [email protected], or your attorney contact at Akerman LLP.