On Friday, May 12, 2023, the IRS released Notice 2023-38 (Notice) providing much needed guidance regarding the requirements to claim the new domestic content bonus credits available under Internal Revenue Code Sections 45, 45Y, 48, and 48E,[1]which were added by the Inflation Reduction Act of 2022 (IRA). In general, the domestic content bonus credit is an additional 10 percent of the otherwise allowable credit amount (Sections 45 and 45Y) or an additional 10 percent tax credit (Sections 48 and 48E) and is available if all of the steel, iron, and manufactured products that are components of the completed Applicable Project (defined below) are produced in the United States, as determined under the domestic content requirements set forth in Section 45(b)(9)(B) (Domestic Content Requirements).[2]The Notice includes detailed rules explaining how to apply the statutory provisions to establish qualification, including a table setting forth safe harbor classifications for certain common components of solar, wind, and battery storage systems (e.g., racking, modules, turbines). The provisions in the Notice reflect what Treasury and the IRS intend to include in forthcoming proposed regulations, and taxpayers may rely on the Notice for projects that start construction prior to the date that is 90 days after the date proposed regulations are published in the Federal Register.

The Notice defines an “Applicable Project” as: (i) a qualified facility under Sections 45 or 45Y; (ii) an energy project under Section 48; or (iii) a qualified investment with respect to a qualified facility or energy storage technology under Section 48E. Sections 45 and 45Y provide for a 10 percent increase to the amount of the otherwise allowed production tax credits when the Domestic Content Requirements are met and the taxpayer provides a statement attesting to such satisfaction. Sections 48 and 48E increase the amount of the otherwise allowed investment tax credit (ITC) by 10 percentage points, provided either (i) the maximum net output of the project is less than one megawatt (AC) or is thermal energy; (ii) the project started construction prior to January 29, 2023; or (iii) certain prevailing wage and apprenticeship requirements are satisfied. Otherwise, the ITC is increased by two percentage points.

The “United States” is defined to include the 50 states, the District of Columbia, Puerto Rico, Guam, America Samoa, the U.S. Virgin Islands, and the Northern Mariana Islands.

Domestic Content Requirements

As noted above, to qualify for the domestic content adder, any steel, iron, or manufactured product which is a component of the applicable project upon completion of construction must be produced in the United States. The Domestic Content Requirements provide for the determination to be made using the so-called Buy America Requirements (set forth in Part 661 of title 49 of the Code of Federal Regulations), which are administered by the Federal Transit Administration (FTA) in the context of transportation assets and the transportation sector. The rules for determining that all of the components of the project were produced or manufactured[3] in the United States are different for components that are classified as steel or iron (Steel or Iron) and components that are classified as manufactured products(Manufactured Products). For Steel or Iron, such determination is made in a manner consistent with section 661.5(b) and (c) of the Buy America Requirements, whereas section 661.5(d) applies for purposes of making the determination with respect to Manufactured Products. Further, Section 45(b)(9)(B)(iii) provides that the Domestic Content Requirements are deemed satisfied with respect to Manufactured Products if not less than the applicable percentage of the total costs of all such manufactured products which are components of the [Applicable Project] are attributable to manufactured products (including components) which are mined, produced, or manufactured in the United States." The applicable percentage for purposes of the foregoing rule (Applicable Percentage Rule) is generally 40 percent for projects that start construction before 2025, with annual increases to a maximum of 55 percent for projects that start construction after 2026.[4] For offshore wind projects, the applicable percentage is 20 percent for projects that start construction prior to 2025, with annual increases to a maximum of 55 percent for projects that start construction after 2027.[5]

The Notice provides helpful clarification of the statutory provisions, which are particularly difficult to parse with respect to the Applicable Percentage Rule and whose meaning is subject to different interpretations. To a large extent, the Buy America Requirements do not provide sufficient guidance to implement the Applicable Percentage Rule because those regulations apply to the transportation industry, which in many instances does not include policy considerations or technology relevant to the Applicable Projects or the domestic content adder.

Observation: U.S. energy security requires domestic manufacturing of critical components and advanced technology needed to build solar, wind and battery storage facilities. However, given that this is a nascent industry with developing and interrelated technology, decisions about how to interpret the exact contours of what constitutes a U.S. manufactured product or a component thereof, as opposed to a subcomponent, necessarily need to consider consequences that are not relevant to transportation. For example, there is very little, if any, U.S. manufacturing of solar PV cells or silicon wafers and there is technology the uses silicon wafers to manufacture solar PV cells. Thus, the determination of whether silicon wafers are considered manufactured products or components thereof could, depending on the relative timing for developing different aspects of the supply chain, affect the development of U.S. manufacturing of PV cells and/or silicon wafers, as well as the timing of relief from current supply chain shortages.

The first step under the Notice is to identify and categorize the components directly incorporated into the completed project as either Steel, Iron, or a Manufactured Product. A Project Component can be any article, material or supply, whether manufactured or unmanufactured. Separate rules apply to Project Components that are classified as Steel or Iron and those categorized as Manufactured Products.

Project Components Classified as Steel or Iron

Steel or iron incorporated into an Applicable Project is considered a Project Component classified as Steel or Iron if such steel or iron has a structural function and the construction materials for such structural component are primarily steel or iron. For a Project Component that is Steel or Iron to satisfy the Domestic Content Requirements, all of the manufacturing with respect to such Steel or Iron must take place in the United States, except metallurgical processes involving refinement of steel additives. A “Manufacturing Process” is defined as the application of processes to alter the form or function of materials or elements of a product in a manner adding value and transforming those materials or elements into a new item that is functionally different from that which would result from mere assembly of the elements or materials.

This requirement does not apply to steel or iron that is used in components of Manufactured Products (Manufactured Product Component) or subcomponents of Manufactured Products (e.g., nuts, bolts, screws, washers, cabinets, covers, shelves, clamps, fittings, sleeves, adapters, tie wire, spacers, door hinges, and similar items made primarily of steel or iron, but which are not structural in function).

Project Components Classified as Manufactured Products

As explained above, a Project Component is considered a Manufactured Product if it is produced through the application of processes that alter or transform the materials or elements of the product into a functionally different item as opposed to mere assembly of such elements or materials. For purposes of the Domestic Content Requirements, all Manufactured Products are deemed produced in the United States if the Applicable Percentage Rule is satisfied, meaning the percentage of the direct costs of all manufactured products that are attributable to manufactured products (including components) which are mined, produced or manufactured in the United States must be at least equal to the applicable percentage.

Perhaps the most important information provided by the Notice is how Treasury and the IRS determined to interpret the meaning of the phrase “manufactured products (including components) which are mined, produced or manufactured in the United States” for purposes of applying the Applicable Percentage Rule. The rules set forth in the Notice are based on the premise that costs attributable to domestically manufactured products (including components) means the cost of each Manufactured Product produced in the United States (U.S. Manufactured Product) plus, with respect to any Manufactured Product that was not produced in the United States (Non-U.S. Manufactured Product), the cost of each Manufactured Product Component included therein which is manufactured in the United States (Domestic Component).

Observation: Many stakeholders in the solar industry had views about the interpretation of the Applicable Percentage Rule due to the implications on the domestic supply chain for solar PV modules and PV cells. Some argued, consistent with the approach taken in the Notice, that U.S. manufactured solar modules that included PV cells imported from China should not qualify as a domestically manufactured product.

The Notice provides detailed rules for determining the amount of such costs (collectively, Domestic Manufactured Products and Components Cost). The first step is to identify the U.S. Manufactured Products incorporated into the completed project. To be so considered, all Manufacturing Processes for the Manufactured Product must take place in the United States and each Manufactured Product Component included in such Manufactured Product must be of U.S. origin. A Manufactured Product Component is considered to be of U.S. origin if it is manufactured in the United States, regardless of the origin of its subcomponents.

All of the manufacturer’s direct costs to produce a U.S. Manufactured Product are included in the Domestic Products and Components Cost.[6] Direct costs are defined in Regulations Section 1.263A-1(e)(2)(i) (i.e., direct materials and direct labor costs that are paid or incurred within the meaning of Section 461).[7]

The next step is to identify each Domestic Component included in the Non-U.S. Manufactured Products incorporated into the Applicable Project. The manufacturer’s direct costs to produce or acquire each Domestic Component contained in a Non-U.S. Manufactured Product is also included in the Domestic Products and Components Cost. This does not include any direct labor or materials costs incurred by the manufacturer within the meaning of Section 461 to produce the Non-U.S. Manufactured Product.

Safe Harbor Classifications

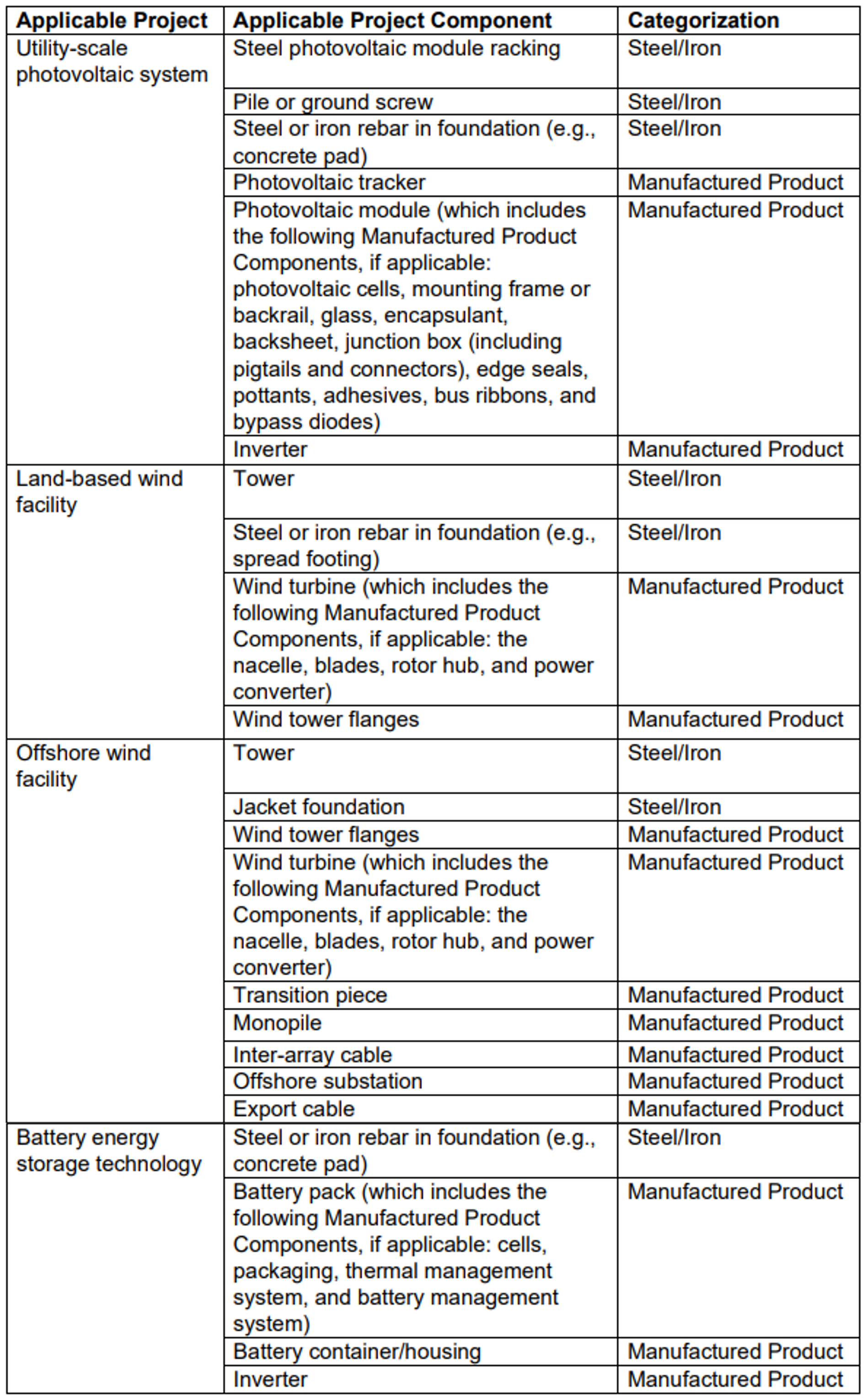

As mentioned, the Buy America Requirements provide rules applicable to the transportation sector and often do not provide sufficient or applicable guidance for purposes of identifying and classifying the Project Components included in various types of Applicable Projects. To that end, the Notice identifies and classifies certain common Project Components included in utility-scale solar PV systems, land-based wind facilities, offshore wind facilities and battery energy storage technologies (Safe Harbor Classifications). The Safe Harbor Classifications are set forth in Table 2 of the Notice, which for certain Manufactured Products includes reference to the Manufactured Product Components included in such Manufactured Product. For example, a PV module is identified as a common Project Component for a utility-scale solar PV system and is classified as a Manufactured Product. A PV cell, backsheet, and encapsulant are listed among the Manufactured Product Components included in a PV module.

Observation: The Notice states that the list of Manufactured Products in Table 2 with respect to an Applicable Project is not intended to be exhaustive, but does not indicate whether the Manufactured Product Components listed with respect to an identified Manufactured Product are intended to be examples of some of the Manufactured Product Components that could be included in such Manufactured Product, or are the only components required to be produced in the United States. Thus, it is unclear whether anything not listed should be considered a subcomponent for purposes of the Applicable Percentage Rule. For example, silicon wafers are manufactured products and are sometimes used to manufacture PV cells. Does the fact that wafers are not expressly listed as Manufactured Product Components of solar modules necessarily mean solar modules that include silicon wafers imported from China can qualify as U.S. Manufactured Products?