In a monumental move yesterday, the Securities and Exchange Commission (the "Commission") continued its commitment to environmental transparency by adopting new climate disclosure rules. These rules, as discussed in the Commission's press release, aim to enhance and standardize climate-related disclosure.

Key Highlights

The final rules, which are significantly scaled back from the Commission's previously proposed rules, introduce several pivotal amendments, underscoring the importance of climate-related information in investment decision-making, including:

- Comprehensive Climate-Related Disclosure: The rules mandate comprehensive disclosure of material climate-related risks and permit voluntary disclosure of climate-related opportunities by issuers, aiming to provide investors with a clearer understanding of the potential impacts on businesses, financial conditions, and operating performances. These disclosures encompass factors such as greenhouse gas emissions, climate-related litigation, physical and transition risks, short-term and long-term risks, and strategies for managing climate-related risks. The rules also mandate disclosure of board oversight of climate-related risks and management's role in assessing and managing climate-related risks.

- Enhanced Transparency and Accountability: The rules seek to promote greater transparency and accountability in the financial markets by ensuring that investors have access to reliable and relevant climate-related information. By requiring issuers to include material climate-related diclosure, the Commission aims to facilitate more informed investment decisions and foster long-term sustainability. For example, the rules will require issuers to disclose any climate-related target or goal if such target or goal has materially affected or is reasonably likely to materially affect the issuer's business, results of operations, or financial condition.

- GHG Emissions Disclosure: Large accelerated filers and accelerated filers, that are not otherwise exempted, must disclose information about material Scope 1 emissions and/or Scope 2 emissions. Such issuers will also be required to file an attestation report with their Scope 1 and 2 emissions. Smaller reporting companies, emerging growth companies, and non-accelerated filers are exempt from such GHG emissions disclosure requirements and accompanying attestation reports.

- Financial Statement Disclosures: The rules require a footnote to the financial statements describing capitalized costs, expenditures, and losses resulting from severe weather events and other natural conditions, subject to applicable 1 percent and de minimis disclosure thresholds (measured against the absolute value of pre-tax income or loss for expenditures expensed as incurred and losses, and the absolute value of stockholders' equity or deficit for capitalized costs and charges incurred). Additionally, a footnote to the financial statements must also disclose if capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates have been used as a material component of the issuer's plans to achieve its disclosed climate-related targets or goals.

The rules also provide for a safe harbor that disclosures related to transition plans, scenario analysis, internal carbon pricing, and targets and goals (other than historical facts) are forward-looking statements for purposes of the Private Securities Litigation Reform Act.

Implications for Issuers

Issuers will need to conduct thorough assessments of their climate-related risks and opportunities and ensure compliance with the new disclosure requirements. When issuers become subject to these new rules, they will need to consider revising their current reporting practices to account for these new disclosure requirements and any other requirements to which the issuer may be subject. This may involve implementing robust reporting mechanisms, enhancing internal controls, and engaging with stakeholders to address emerging climate-related concerns.

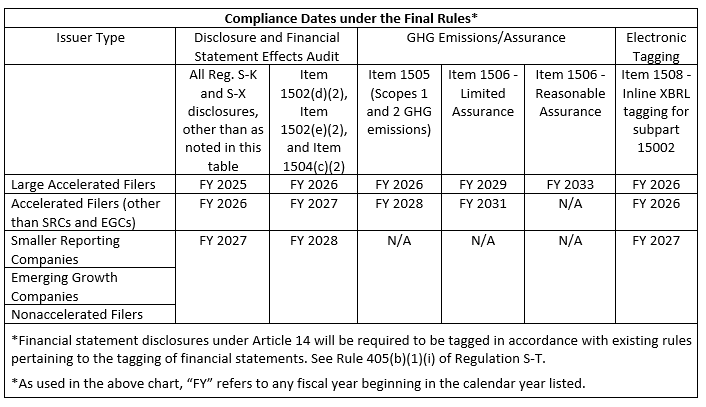

Compliance with the final rules, which will become effective 60 days after publication in the Federal Register, will be phased in as follows:

Source: Fact Sheet: The Enhancement and Standardization of Climate-Related Disclosures: Final Rules

Navigating Securities Regulatory Changes

Our Capital Markets Practice understands the complexities of navigating regulatory changes and ensuring compliance with the rapidly evolving disclosure requirements for public companies, and we are committed to helping our clients navigate the Commission's new climate disclosure rules effectively. We can provide tailored guidance on assessing your current disclosure practices, implementing necessary changes to meet the Commission's standards, and mitigating potential risks associated with non-compliance. For personalized guidance on navigating the Commission's new rules and their implications for your public company, we encourage you to contact our Capital Markets team.

Connect With Us

Esther L. Moreno

Co-Chair, Capital Markets Practice

+1 305 982 5519

Email

Christina C. Russo

Co-Chair, Capital Markets Practice

+1 305 982 5531

Email