The DOE Portal for submitting applications to the "Low-Income Communities Bonus Credit Program" for all four facility categories opens on October 19, 2023, at 9:00 am ET. All applications received by November 18 at midnight will be treated as received at the same time. Thereafter, applications will be accepted and reviewed on a rolling basis.

Owners of small solar and wind facilities that qualify for the new 10 or 20 percent tax credit adder under IRC Section 48(e) must submit applications to the program and receive allocations of the annual "Capacity Limitation" in order to claim the bonus credits on their tax returns. IRC Section 48(e) was added by the Inflation Reduction Act of 2022 (IRA) to encourage investment in and construction of small solar and wind facilities in targeted low-income areas.

The IRA authorizes the Treasury Department and the IRS to allocate up to 1.8 gigawatts direct current (DC) capacity among owners of qualified facilities for each of 2023 and 2024. The methodology for making award determinations and information regarding the 2023 application process is provided in Treasury Regulations (TD 9979) and accompanying Revenue Procedure 2023-27, which were published on August 15, 2023. The final regulations largely follow proposed regulations published in a Notice of Proposed Rule Making on June 1, 2023.

The 10 or 20 percent bonus credit is on top of the energy investment tax credit (ITC) for qualified solar and wind projects below five megawatts capacity in alternating current (AC), and connected storage, that are either (i) located in a low-income community or on Indian land (10 percent adder) or (ii) are part of a "qualified low-income residential building project" or a "qualified low-income economic benefit project" (20 percent adder).

The following is to highlight some of the key aspects of the application process. A more detailed explanation of IRC Section 48(e), the program, and the rules established by Treasury and the IRS can be found in our discussion of the Notice of Proposed Rule Making from June 2023.

Application Process Overview

- The individual who will register the applicant and complete the application needs to register for a login.gov account in order to access the DOE Portal. This can be done before the portal opens.

- Complete the Applicant Registration section on the portal, providing information about the applicant.

- Complete the application for an allocation of capacity limitation for the specific facility. A considerable amount of information is needed to complete the application. The Applicant Checklist on the DOE website provides useful information about what you will need. The applicant must submit separate applications for each facility it owns.

- Applications need to be submitted via the portal between October 19 and midnight ET on November 18 to be considered in the first round. Applications submitted after the first round will be considered for any remaining capacity limitation based on the date received. The DOE website will have real-time updates on remaining capacity limitation by category.

- The DOE team conducts an initial review of the application and provides a recommendation to the IRS as to whether to award the allocation. During this process, the DOE may request additional information. The applicant has 21 business days to respond.

- The IRS reviews the DOE team's recommendation, then makes the allocation determination and notifies the applicant whether the allocation is awarded or denied. Notification will only be provided via the portal. The IRS's determination is final (i.e., no dispute process). This notice does not by itself give the applicant the right to claim the adder, as there is another review process after the facility is placed in service.

- The applicant must complete the Placed-in-Service step on the portal once the facility is placed in service. This is to confirm the facility meets the requirement of being placed in service within four years of notice of the award and information about the facility has not changed from what was provided in the application. For example, there are restrictions on changes to the name plate capacity of the facility. See the discussion below regarding placed-in-service requirements.

- The DOE team reviews the placed-in-service information and provides an eligibility recommendation to the IRS, again with the potential for a request for additional information.

- The IRS reviews the DOE recommendation and makes the eligibility determination, which again is final.

Categories and Award Determinations

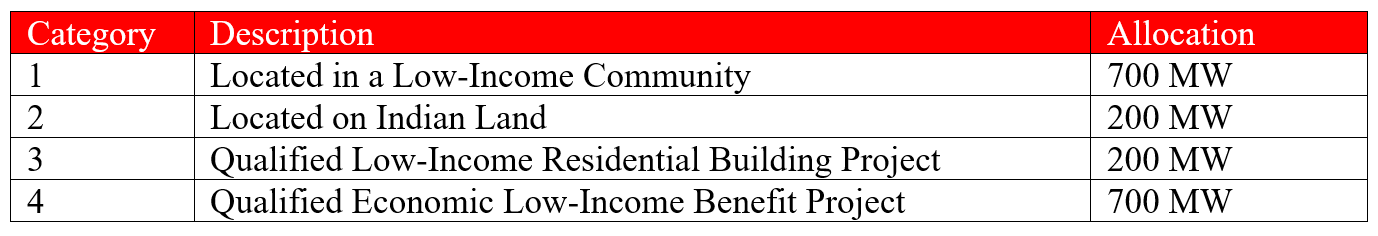

Applications are considered separately among four categories, with each category being allocated a set portion of the total 1.8 gigawatts capacity limitation. The allocations for 2023 are in the chart below. The Treasury Department and IRS have discretion to reallocate any remaining unused capacity in one category to an oversubscribed category.

During the initial 30-day application period, the capacity limitation apportioned to each category is first allocated to facilities in the category that satisfy advanced selection criteria based on ownership or geographical location. If any portion of the capacity limitation for the category remains after allocations are made to the prioritized facilities, it will be allocated to the remaining facilities in the category, subject to a 50 percent minimum reserve for facilities in the category that satisfy one or more of priority criteria. If there is not enough remaining capacity limitation for the unprioritized facilities, such remaining capacity limitation will be allocated among the unprioritized facilities by lottery.

For example, if 200 megawatts were allocated to qualified low-income economic benefit projects (Category 4) that meet either or both the ownership and location criteria, 150 megawatts of the remaining 500 megawatts apportioned to Category 4 would be reserved, leaving only 350 megawatts of capacity for allocation among the non-prioritized Category 4 facilities, which may need to be allocated by lottery.

The resources listed below have more information about the advanced selection criteria and requirements for the various categories.

Placed-in-Service Requirements

As noted above, there are placed-in-service requirements that need to be met and which are reviewed during the placed-in-service phase of the application process. Some key highlights to be aware of include:

- The award will be forfeited if the facility is placed in service prior to notice of the allocation award.

- The facility must be placed in service no later than four years from the date of notice of the award.

- Changes to the nameplate capacity can cause disqualification or reduce the amount of the award. If capacity increases such that it equals or exceeds 5 MW, the allocation is forfeited. If capacity increases but remains below the 5 MW cap, the 10 or 20 percent adder is reduced proportionately to the amount of the capacity increase. A decrease in nameplate capacity by more than the greater of 2 kW or 25 percent of the allocated capacity will disqualify the facility. Smaller reductions do not affect the amount of the award.

- Until the IRS has confirmed eligibility through the DOE Portal, the bonus tax credit cannot be claimed on the taxpayer's return, claimed via a direct pay election under IRC Section 6417, or transferred pursuant to IRC Section 6418.

Useful Resources

- Maps for Category 1 and Geographic Selection Criteria

- Eligible Covered Housing Programs for Category 3

- Household Income Limits for Category 4

- IRS Factsheet

- Frequently Asked Questions

- Applicant User Guide

- DOE Webinar recording from September 29, 2023, and power point slides

The DOE expects to receive a significant number of applications. Accordingly, it would be prudent to complete your application by the November 18 deadline to be considered in the initial review period. That said, it is important to take the time and care needed to complete the application correctly and completely, and all applications received during the initial period are treated as received on the same day. That may not be the true, however, if additional information is requested and provided after the initial period ends and award determinations are being made.