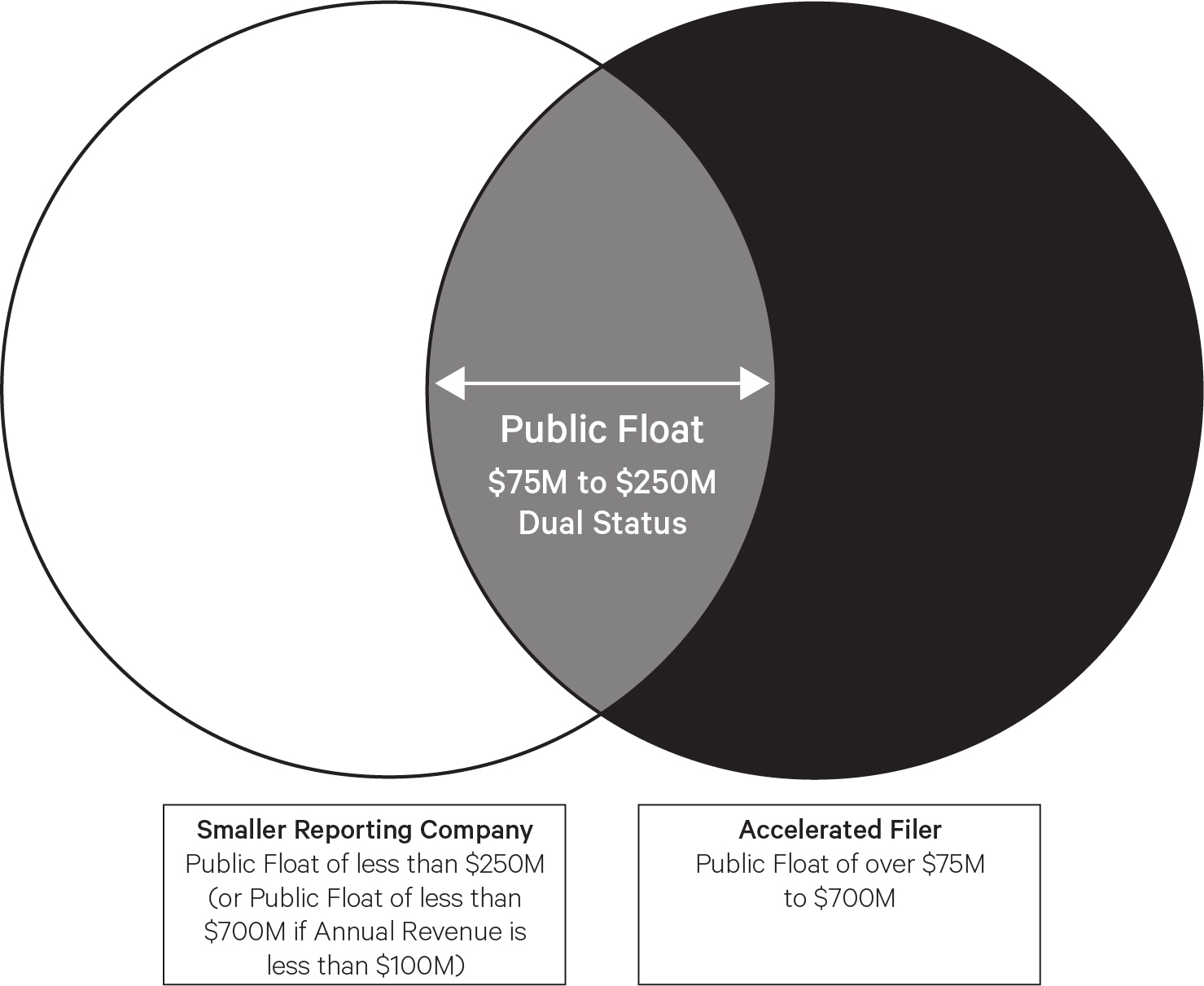

When the Securities and Exchange Commission (the "Commission") adopted amendments to raise the thresholds in the smaller reporting company definition last year, the Commission did not make the corresponding amendments to the definitions of “accelerated filer” and “large accelerated filer.” As a result, issuers with a public float of $75 million or more (but less than $700 million) continued to be considered accelerated filers even if they qualify as smaller reporting companies, and would be required to comply with certain of the requirements applicable to accelerated filers. The Commission confirmed the reality of this newly created 'dual status' in the Final Rule and the Division of Corporation Finance’s Compliance & Disclosure Interpretations for Regulation S-K, Question 102.01. Earlier this year, the Commission proposed rules to amend the definitions of accelerated filer and large accelerated filer to fix this conundrum but the comment period has expired, and to date, the definitions remain unchanged. Below is a graphic illustration of how an issuer can have a dual status. Note, this illustration assumes the issuer has annual revenue in excess of $100 million.

December 3, 2019

By Esther L. Moreno, Christina C. Russo, and Tara A. Jackson

This change creates some confusion for issuers and adds complexity that extends far beyond checking an additional box on the cover page of Securities Act and Exchange Act forms. One important fact to note is that the filing deadlines for annual and quarterly reports differ for smaller reporting companies and accelerated filers:

- For smaller reporting companies (non-accelerated filers), the annual report on Form 10-K is due 90 days after the end of the fiscal year and quarterly reports on Form 10-Q are due 45 days after the end of the fiscal quarter.

- For accelerated filer (non-smaller reporting companies), the annual report on Form 10-K is due 75 days after the end of the fiscal year and quarterly reports on Form 10-Q are due 40 days after the end of the fiscal quarter.

- Issuers holding dual status as a smaller reporting company and accelerated filer are required to follow the deadlines for accelerated filers.

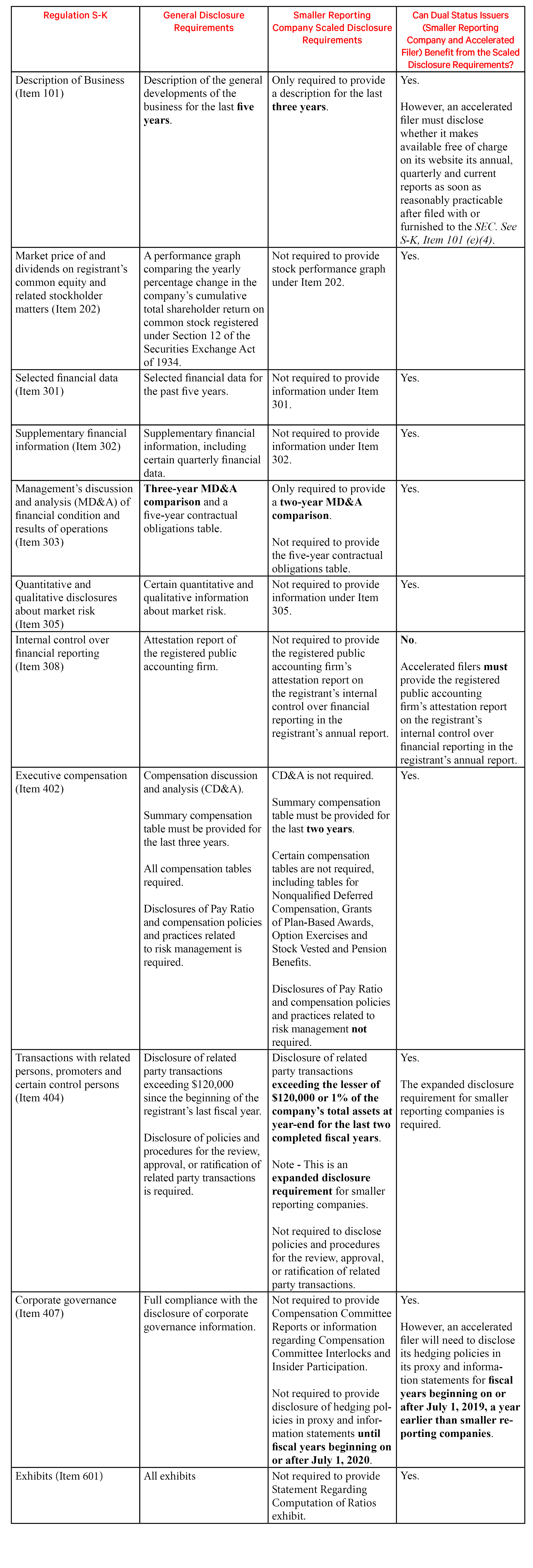

Additionally, there are some other complexities that issuers holding dual status must consider when drafting securities disclosures. The following table summarizes certain disclosure requirements under Regulation S-K, the scaled disclosure requirements available to smaller reporting companies, and clarifies whether issuers with dual status as a smaller reporting company and an accelerated filer are able to benefit from such scaled disclosures.

This Akerman Practice Update is intended to inform firm clients and friends about legal developments, including recent decisions of various courts and administrative bodies. Nothing in this Practice Update should be construed as legal advice or a legal opinion, and readers should not act upon the information contained in this Update without seeking the advice of legal counsel.