Every year, the Department of Justice (DOJ) releases its annual False Claims Act (FCA) enforcement statistics. On February 22, 2024, the DOJ announced that it had recovered nearly $2.7 billion from FCA resolutions during Fiscal Year (FY) 2023 (ending Sept. 30, 2023).[1]

"In short, by every measure, fiscal year 2023 was another strong year for False Claims Act enforcement," according to Principal Deputy Assistant Attorney General Brian M. Boynton in his remarks on the FY 2023 statistics at the Federal Bar Association Qui Tam Section Conference in Washington, D.C., on February 22, 2024.[2]

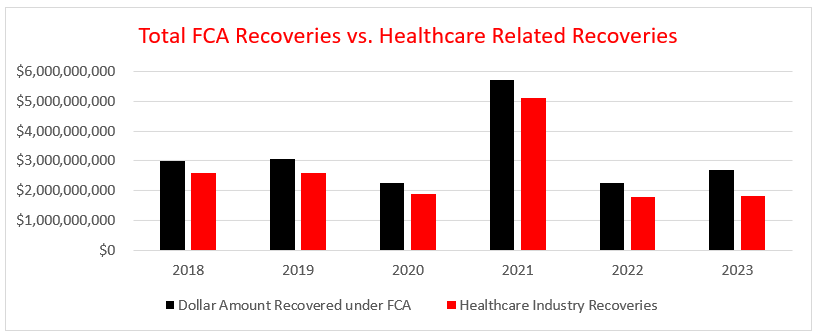

While the nearly $2.7 billion recovered in FY 2023 reflects a modest 23 percent (approximate) increase over the $2.2 billion recovered in FY 2022, it nonetheless reflects the third lowest FCA recovery since FY 2013 and markedly less than the $5.7 billion the DOJ recovered in FY 2021 or its highwater mark of $6.1 billion in FYI 2014. Nevertheless, FY 2023 remains in line with DOJ's trend since FY 2009 of collecting in excess of $2.2 billion in annual recoveries.[3]

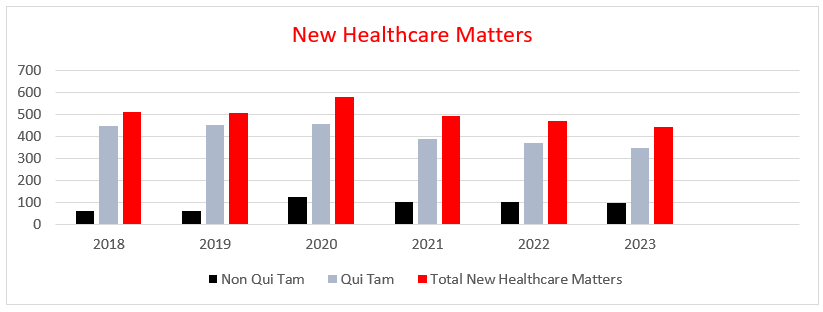

The healthcare industry once again played a disproportionate role in FCA recoveries, accounting for over $1.8 billion, or nearly 68 percent, of the nearly $2.7 billion in total government FCA recoveries in FY 2023. FCA enforcement of Department of Defense contracts accounted for over $551 million, or more than 20 percent of total recoveries, with $377 million coming from one settlement alone. Matters outside of the healthcare and defense industries accounted for the remaining $319 million, or nearly 12 percent of total recoveries in FY 2023.

Notably, the share of healthcare industry recoveries floated between 80 and 90 percent of total recoveries from FY 2018 (88 percent) to FY 2022 (80 percent). At 68 percent, FY 2023 represents the lowest percentage of total recoveries related to healthcare since FY 2018. However, historical figures reflect that the position of healthcare as a primary target of FCA enforcement is well entrenched, and although the percentage can vary, healthcare seldom reflects a position below 40 percent of the total FCA recoveries in any given year.

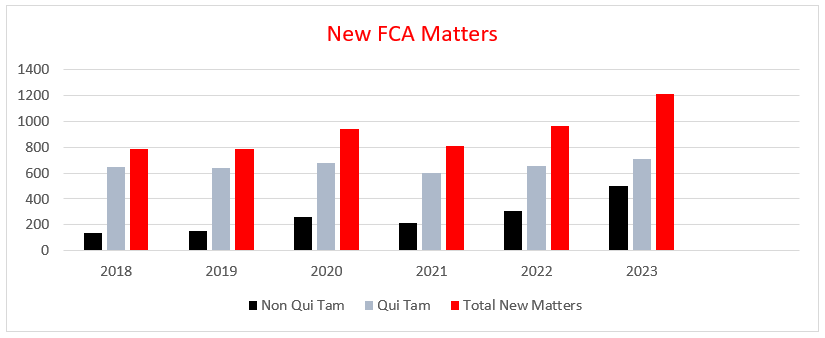

FY 2023 also saw a number of new FCA enforcement records. The DOJ recorded the highest ever number of FCA-related case resolutions in 2023, with 543 settlements and judgments, representing a 54 percent increase over FY 2022, which was, at that time, the second highest record. An extraordinarily small percentage of FCA cases ultimately go to trial.

The number of new matters opened by the government and relator proxies also reached an all-time high at 1,212. Of those new matters, 500 were opened by the DOJ itself as new non-whistleblower matters, an all-time high clearing the previous record of 340 set in FY 1987, the first fiscal year following the 1986 amendments. This is only the third time that the number of new matters opened by the DOJ in a fiscal year topped 300, and represents vigorous enforcement on its own initiative. The DOJ Fraud Section also set an all-time record by issuing 1,504 Civil Investigative Demands in FY 2023.[4]

New whistleblower matters reached 712 in FY 2023, the third-highest record behind FY 2013 (757) and FY 2014 (716). Overall, FY 2023 resolutions in lawsuits filed by whistleblowers, whether or not the government intervened, were the source of $2.3 billion, or nearly 87 percent, of FCA recoveries, representing the highest dollar amount of recoveries stemming from whistleblower actions since FY 2017 ($3.1 billion). Whistleblowers in FY 2023 received nearly $350 million, over $200 million of which went to relators in healthcare resolutions. This brings the total amount relators have reaped in their share of successful FCA resolutions since FY 1986 to about $9 billion, $6.9 billion (77 percent) of which has gone to relators in healthcare resolutions.

FCA Enforcement Trends in Healthcare

Within healthcare, the government's recoveries and statements about future enforcement reveal at least four trends:

- FCA enforcement followed its years-long trend of pursuing allegations of billing for unnecessary healthcare services, substandard care, and improper billing;

- An uptick in enforcement related to the Medicare Advantage (Medicare Part C) program, recovering $194.5 million from two settlements alone;

- Continued pursuit of violations of the Anti-Kickback Statute (AKS), including by physicians and their practices, hospital systems, and an Electronic Health Records (EHR) vendor; and

- An increased focus on third-party actors investing in healthcare entities, such as private equity and venture capital firms.

Accordingly, because the healthcare industry remains the leading target for FCA-related recoveries, healthcare decision-makers should pay close attention to these trends and enforcement priorities and plan their compliance programs and resources accordingly.

1. Substandard Care and Unnecessary and Improper Billing

In FY 2023, the DOJ continued to pursue the bread and butter of healthcare fraud — improper and unnecessary billing — in settlements that covered healthcare entities ranging from physician practices to medical device companies, laboratories, and compounding and specialty pharmacies to acute care facilities and skilled nursing facilities. Settlements in this area ranged from just under $250,000 to well over $40 million.

For example, a vascular surgeon in Michigan was sentenced to 80 months in prison and ordered to pay up to $43.4 million to resolve allegations that he had violated the FCA, in addition to $19.5 million in restitution to federal and state payors. The allegations involved billing for unperformed and unnecessary heart procedures, such as placing multiple vascular stents in the same blood vessel and fabricating medical records to justify these actions.[5]

A Beverly Hills plastic surgeon, his son, and his medical practices and billing company agreed to pay $23 million to resolve allegations they fraudulently maximized reimbursement from Medicare and Medicaid by manipulating the place of service code on claims for skin grafts. The government also alleged that the physician did not dispose of single-use skin graft materials left over from previous procedures, using them instead for Medicare and Medicaid beneficiaries yielding thousands of claims that were double billed to government payors.[6]

Former unlicensed operators of a nursing home and the landlord who gave them control of the facility paid $7.1 million to resolve allegations they submitted false claims to Medicaid for worthless services. In 2019, CMS placed the nursing home on a list of the worst-performing nursing homes nationwide. The government alleged that the nursing home provided worthless services to residents and that the physical conditions deteriorated to a degree that violated federal and state regulations, including lacking hot water, inadequate staffing and linen inventory, medication errors, unnecessary falls, and residents developing pressure ulcers.[7]

Two pharmacies and their owner agreed to pay at least $7.4 million to resolve allegations they added the antipsychotic drug aripiprazole to topical compounded pain creams to boost reimbursement from Medicare Part D and TRICARE, the federal healthcare program for active military personnel, retirees, and their families. The defendants also allegedly routinely waived copayments. The government alleged the defendants crushed aripiprazole pills intended and only approved for oral use and included them in compounded creams, knowing that there was no clinical basis to do so.[8]

A billing company for diagnostic laboratories agreed to pay $300,479.58 and admitted liability in the face of allegations that it submitted claims to Medicare for unnecessary respiratory panels run on seniors receiving COVID-19 testing in 2020. Notably, the billing company received a credit from the DOJ for cooperating with the government by performing and disclosing the results from an internal investigation, as well as sharing relevant material facts not known by the government.[9]

2. Medicare Advantage

The DOJ continued enforcement related to Medicare Advantage (Medicare Part C), whose beneficiaries comprise more than half of all Medicare beneficiaries and the federal spend. Two settlements alone totaled more than $194.5 million.

First, a nationwide owner and operator of Medicare Advantage Organizations paid over $172 million to settle allegations that it operated a "chart review" program in which diagnosis coders reviewed charts from healthcare providers to see where it could add billing codes for additional CMS payments, while simultaneously failing to withdraw or delete inaccurate and untruthful diagnosis codes.[10] The government also alleged that the company reported diagnosis codes based solely on forms completed during in-home assessments of plan members. The providers conducting these assessments allegedly did not use diagnostic testing or imaging necessary to make such diagnoses. Notably, other healthcare providers seeing the patient in the same year did not report these diagnoses. The company also allegedly improperly benefitted from submitting or failing to correct inaccurate and untruthful diagnosis codes for morbid obesity for beneficiaries with a BMI below 35. The owner of the Medicare Advantage Organizations entered into a five-year Corporate Integrity Agreement (CIA) with the U.S. Department of Health and Human Services Office of Inspector General (HHS-OIG). The whistleblower, a part-owner of a vendor retained by the company for in-home visits, received over $8 million related to the home-visit allegations.[11]

Second, a Medicare Advantage plan operator in Maine and New Hampshire paid nearly $22.5 million to settle allegations that it engaged in chart reviews and added additional diagnosis codes that were not supported by patient records. The whistleblower, a former manager in the company's Risk Adjustment Operations group, received $3.8 million.[12]

3. Anti-Kickback Statute

Enforcement of violations of the Anti-Kickback statute (AKS) continued in full force for FY 2023. Parties settling AKS claims included an EHR vendor, hospital systems, skilled nursing facilities, and individual physicians and their practices. Multiple recoveries from such settlements reached over $30 million.

An Electronic Health Record technology vendor agreed to pay $31 million to resolve allegations it violated the FCA by misrepresenting capabilities of its software and falsely obtaining certification pursuant to CMS' EHR Incentive Payment Program. The government also alleged the vendor violated the AKS by giving credits of up to $10,000 to customers whose recommendation of the software resulted in a new sale, in addition to allegations it offered improper remuneration for referrals and purchases in the form of tickets to sporting and entertainment events. These inducements led users of the company's EHR to submit claims for incentive payments under the Meaningful Use Programs that were tainted because the EHR did not contain the functionality required for certification.[13]

A Michigan medical center and its owners agreed to pay nearly $30 million to resolve allegations of FCA and AKS violations. The government alleged that the medical center's hospitals provided the services of mid-level practitioners to thirteen physicians at no cost or below fair market value, violating the AKS. The government alleged these physicians were selected because of their substantial number of patient referrals to the hospital and to induce the physicians to refer more Medicare patients to the medical center's hospitals.[14]

A specialty pharmacy and its CEO agreed to pay $20 million, based on ability to pay, to resolve allegations they violated the AKS by routinely waiving copays for expensive drugs and services without regard to financial hardship. The government also alleged that the pharmacy provided gifts, dinners, and administrative and clinical support to physicians, including a neurologist who agreed to a separate $480,000 settlement.[15]

A medical device manufacturer paid $9.7 million to resolve allegations it paid kickbacks to an orthopedic surgeon to induce the physician's use of its products. Sales staff for the manufacturer offered the surgeon free spinal implants and other tools including cages, rods, screws, plates, and surgical instruments for use by the physician in surgeries outside of the United States.[16]

A skilled nursing facility agreed to pay $3.8 million to resolve allegations that it violated the FCA and AKS by giving extravagant gifts to physicians and their spouses to induce and reward referrals, including golf trips, limousine rides, massages, e-reader tablets, and gift cards worth up to $1,000 in addition to monthly stipends purportedly for medical director services.[17]

Three pain management doctors and their practices agreed to pay $656,796 to resolve allegations they violated the FCA and AKS. They agreed to cooperate with the DOJ in proceedings against other participants. The physicians' practices received payments from a purported MSO in return for ordering lab tests from specific laboratories.[18]

A physician and his South Carolina medical practice agreed to pay $585,540 to resolve allegations they violated the FCA and AKS by receiving kickbacks for referrals for laboratory testing. The physician agreed to cooperate with the DOJ in proceedings against other participants in the schemes. The physician allegedly received kickbacks disguised as office space rental and phlebotomy payments, free clinical staff services unrelated to the laboratory offering them, and remuneration disguised as consulting and medical director payments.[19]

4. Private Equity and Venture Capital

As private equity and venture capital firms expand their investments in healthcare, the DOJ is watching. Principal Deputy Assistant Attorney General Brian M. Boynton noted that the DOJ has already pursued cases involving private equity firms in recent years. He expressed concern with firm-set revenue targets or other benchmarks that put reimbursement first.[20]

In light of these comments, healthcare investors should conduct robust due diligence (pre- or post-closing) to assess internal auditing and compliance programs and potential FCA exposure. They should also consider the level of direct control that they have over the newly purchased entity and should remain mindful of indirect influences that equity stakeholders could have on compliance functions. The DOJ specifically highlighted revenue targets, but other factors are significant as well. How a company responds to compliance concerns and who makes compliance decisions (and the factors being considered) will also play a significant role in DOJ enforcement decisions.

This enforcement trend is consistent with multiple recent congressional inquiries into private equity's role in healthcare, and it is likely to continue well into 2024 and beyond.[21]

Other Key FCA Takeaways From FY 2023

1. DOJ FCA Cooperation Credits

In 2019, the DOJ updated the Justice Manual at Section 4-4.112 to detail how it would award credit to defendants who cooperate during government FCA investigations.[22] In the ensuing four years of enforcement press releases, the DOJ did not include any notes on when, how, why, or whether it actually awarded such credits to defendants. That changed in FY 2023. The DOJ has begun to acknowledge credits provided to cooperative defendants in its press releases. While scant data exists at this point, the pool of data may increase in future years and should be monitored.

2. Notable FCA Matters From Other Industries

In one of the largest government procurement settlements ever, a company that provides management, engineering, and consulting services through government and military contracts agreed to pay $377 million to resolve allegations it billed the government for costs related to separate, non-government contracts that provided nothing to the United States.[23]

A government contractor and its manager agreed to pay $293,771 to resolve allegations they failed to secure personal information for applicants to the federally funded Florida children's Medicaid enrollment website that it created and maintained. After suffering a cyber-attack, the personal information of 500,000 applicants was potentially exposed.[24] The settlement signals continued enforcement in cyber fraud matters by the DOJ, which launched a Cyber-Fraud Initiative in 2021 with the aim of promoting cybersecurity compliance in government contracts.

Another federal government contractor agreed to pay over $4 million to resolve cybersecurity lapses in government contracts for secure internet connections. The contractor received credit for cooperating with the DOJ by disclosing and remediating failures, providing a written self-disclosure, starting an independent investigation, and providing the government with further written disclosures.[25]

The DOJ also continued its pursuit of pandemic-related fraud under the Paycheck Protection Program (PPP), resolving around 270 FCA matters totaling $48.3 million in FY 2023.

Although the DOJ targeted government and military contractors, cybersecurity breaches, and PPP fraud in its FCA enforcement actions during the last fiscal year, the DOJ's perennial focus on healthcare fraud discussed above continues to result in the highest amounts of FCA recoveries.

The Past May Be Becoming Prologue

The trends identified in FY 2023 appear to be extending into the first half of FY 2024 (which began October 1, 2023), including, for instance, large settlements involving the Anti-Kickback Statute and Stark Law.

In December 2023, a healthcare network in Indiana agreed to pay $345 million to settle allegations it submitted claims for services that were referred in violation of the Stark Law. The government alleged that in 2008 and 2009 senior management initiated a scheme to recruit employee physicians with inflated salaries to profit from referrals by those physicians. The complaint also alleged that management ignored multiple warnings from a valuation firm it hired to analyze the compensation packages it offered the physicians.[26]

An Illinois-based mobile Cardiac PET Scan provider and its owner agreed to pay $85 million in October 2023 to resolve allegations that they violated the AKS and the Stark Law by paying cardiologists excessive fees to supervise scans. The company agreed to pay $75 million plus additional amounts based upon future revenues, and the owner agreed to pay nearly $10.5 million.[27]

Also in October 2023, a provider of genomic-based clinical diagnostic tests agreed to pay $32.5 million to resolve allegations it conspired with hospitals and physicians to work around Medicare's 14-Day Rule for genomic cancer tests.[28]

In December 2023, another diagnostic company and its subsidiary paid over $14.7 million to resolve government allegations related to remote cardiac monitoring services.[29] The same diagnostic company and another one of its subsidiaries had previously settled FCA claims for nearly $45 million in FY 2023 related to outsourcing cardio monitoring data analysis to India.[30] In the more recent matter, the government alleged the company and its sales staff continuously steered office staff to bill for the most expensive services, even where physicians explicitly asked for another service.[31]

Conclusion

In FY 2023, the FCA remained the most powerful weapon in the DOJ's arsenal to combat fraud and recoup funds (allegedly) improperly billed to, or withheld from, the government. The DOJ continued its longstanding trend of targeting healthcare entities that billed federal programs for healthcare services that were unnecessary, not provided, or so substandard as to be considered worthless. Fueled by two mega settlements, the DOJ recovered more from Medicare Advantage plans in FY 2023 than its historical norm. The DOJ also continued to rely upon the federal AKS as an effective enforcement tool in conjunction with the FCA, targeting physician practices, hospital systems, and an EHR vendor who allegedly provided or received improper remuneration to induce and/or reward patient referrals. As Congress sharpens its scrutiny of investments by private equity and venture capital firms in healthcare, the DOJ has likewise increased its focus on such third-party investors.

Although the DOJ also pursued FCA allegations regarding military contractors, cybersecurity, and PPP fraud, among others, the healthcare industry continued to dominate FCA enforcement actions in FY 2023, a trend that continues into FY 2024. There is some comfort to potential targets of FCA allegations, however, as the DOJ, for the first time in FY 2023, acknowledged the credit it provided to cooperative defendants in FCA investigations.

A robust review of these enforcement trends provides valuable compliance insights for any organization conducting itself in the most heavily regulated industry in the world — American healthcare. Akerman has a team of attorneys dedicated to advising clients about healthcare compliance as well as FCA and anti-kickback litigation.

[1] https://www.justice.gov/opa/pr/false-claims-act-settlements-and-judgments-exceed-268-billion-fiscal-year-2023.

[2] https://www.justice.gov/opa/speech/principal-deputy-assistant-attorney-general-brian-m-boynton-delivers-remarks-2024.

[3] Since the FCA was amended in 1986 to include the threat of treble damages, DOJ has recovered more than $75 billion.

[4] https://www.justice.gov/opa/speech/principal-deputy-assistant-attorney-general-brian-m-boynton-delivers-remarks-2024.

[5] https://www.justice.gov/opa/pr/michigan-vascular-surgeon-sentenced-80-months-prison-health-care-fraud-conviction-and-agrees.

[6] https://www.justice.gov/opa/pr/beverly-hills-plastic-surgeon-agrees-pay-nearly-24-million-settle-false-claims-act.

[7] https://www.justice.gov/opa/pr/landlord-and-former-operators-upstate-new-york-nursing-home-pay-7168000-resolve-false-claims.

[8] https://www.justice.gov/opa/pr/two-jacksonville-compounding-pharmacies-and-their-owner-agree-pay-least-74-million-resolve.

[9] https://www.justice.gov/opa/pr/lab-billing-company-settles-false-claims-act-allegations-relating-unnecessary-respiratory.

[10] https://www.justice.gov/opa/pr/cigna-group-pay-172-million-resolve-false-claims-act-allegations.

[11] https://www.justice.gov/opa/pr/cigna-group-pay-172-million-resolve-false-claims-act-allegations.

[12] https://www.justice.gov/opa/pr/martins-point-health-care-inc-pay-22485000-resolve-false-claims-act-allegations.

[13] https://www.justice.gov/opa/pr/electronic-health-records-vendor-nextgen-healthcare-inc-pay-31-million-settle-false-claims.

[14] https://www.justice.gov/opa/pr/detroit-medical-center-vanguard-health-systems-and-tenet-healthcare-corporation-agree-pay.

[15] https://www.justice.gov/opa/pr/united-states-settles-kickback-allegations-biotek-remedys-inc-chaitanya-gadde-and-dr-david.

[16] https://www.justice.gov/opa/pr/depuy-synthes-inc-agrees-pay-975-million-settle-allegations-concerning-kickbacks-paid.

[17] https://www.justice.gov/opa/pr/california-skilled-nursing-facility-and-management-company-agree-pay-3825-million-settle.

[18] https://www.justice.gov/opa/pr/missouri-physicians-and-pain-management-practices-agree-pay-over-650000-settle-kickback.

[19] https://www.justice.gov/opa/pr/south-carolina-physician-and-nephrology-practice-agree-pay-over-585000-settle-laboratory.

[20] https://www.justice.gov/opa/speech/principal-deputy-assistant-attorney-general-brian-m-boynton-delivers-remarks-2024.

[21] See, e.g., https://www.fiercehealthcare.com/providers/senator-probes-private-equity-physician-staffing-firms-emergency-care-cost-cutting.

[22] https://www.justice.gov/opa/pr/department-justice-issues-guidance-false-claims-act-matters-and-updates-justice-manual.

[23] https://www.justice.gov/opa/pr/booz-allen-agrees-pay-37745-million-settle-false-claims-act-allegations.

[24] https://www.justice.gov/opa/pr/jelly-bean-communications-design-and-its-manager-settle-false-claims-act-liability.

[25] https://www.justice.gov/opa/pr/cooperating-federal-contractor-resolves-liability-alleged-false-claims-caused-failure-fully.

[26] https://www.justice.gov/opa/pr/indiana-health-network-agrees-pay-345-million-settle-alleged-false-claims-act-violations.

[27] https://www.justice.gov/opa/pr/mobile-cardiac-pet-scan-provider-and-founder-pay-85-million-resolve-allegedly-unlawful.

[28] https://www.justice.gov/opa/pr/genomic-health-inc-agrees-pay-325-million-resolve-allegations-relating-submission-false.

[29] https://www.justice.gov/opa/pr/biotelemetry-and-lifewatch-pay-more-147-million-resolve-false-claims-act-allegations.

[30] https://www.justice.gov/opa/pr/cardiac-monitoring-companies-pay-more-448-million-resolve-false-claims-act-liability-relating.

[31] https://www.justice.gov/opa/pr/biotelemetry-and-lifewatch-pay-more-147-million-resolve-false-claims-act-allegations.