On December 29, 2022, Congress passed a 4,000+ page Consolidated Appropriations Act, which includes a shorter section governing retirement plans titled "SECURE 2.0 Act of 2022" (SECURE 2.0), the sequel to 2019's SECURE Act (SECURE 1.0).

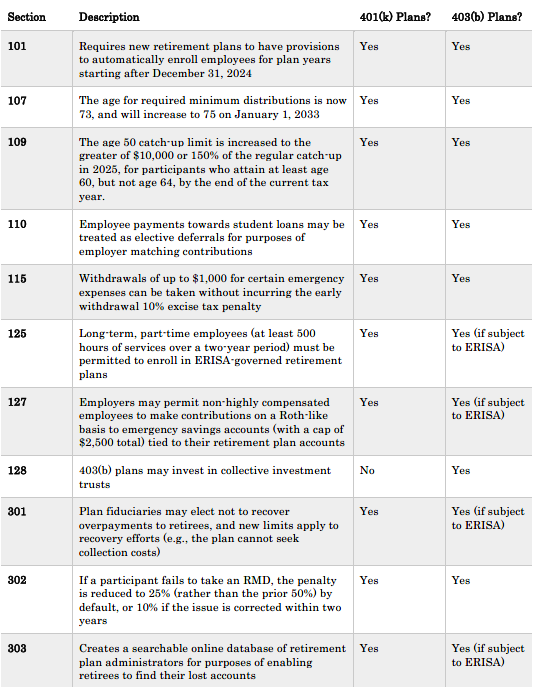

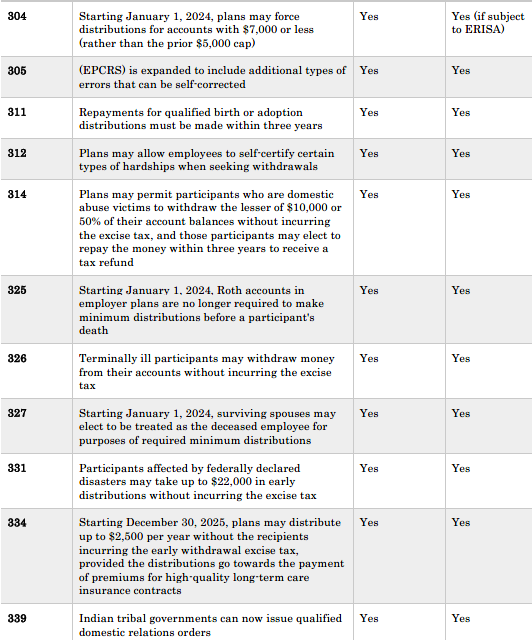

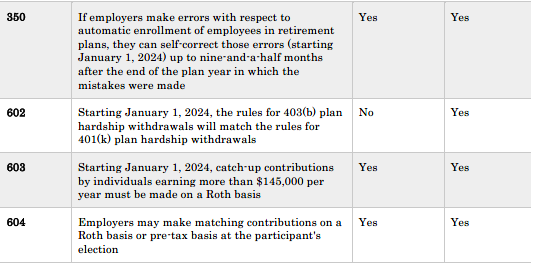

Below are the provisions most likely to impact plan sponsors (noting that this alert is not intended to be a comprehensive summary of all of the changes under SECURE 2.0), followed by a chart outlining the key provisions (complete with section numbers).

I. Increased Eligibility and Automatic Enrollment

Part-Time Employee Eligibility. Under the Employee Retirement Income Security Act of 1974, as amended (ERISA), employers can require employees to complete at least 1,000 hours of service in a consecutive 12-month period before allowing them to participate in the retirement plan. SECURE 1.0 broadened the availability of access to retirement plans by requiring that part-time employees who work at least 500 hours per year in each of three consecutive years be given the right to make elective deferrals under the retirement plan. This essentially eliminated the right to exclude these employees from participation in the plan. SECURE 2.0 further expanded this right of part-time employees by shortening the lookback period from three to two consecutive years. For 401(k) plans, pre-2021 service is disregarded for eligibility and vesting purposes, and for other plans, only service for plan years before January 1, 2023 is disregarded.

Auto-Enrollment Requirement for New Plans. Another way SECURE 2.0 seeks to broaden participation in retirement plans subject to ERISA is by requiring plans that are first established after its enactment to have automatic enrollment and contributions as the default for employees (i.e., employees must affirmatively opt out) for plan years beginning after December 31, 2024. The initial automatic enrollment must be 3 to 10 percent, and it must increase by 1 percent each year until it is between 10 to 15 percent.

II. Changes Impact Employee and Employer Contributions

Matching Student Loan Payments. Congress further memorializes in SECURE 2.0 (only previously documented in private letter rulings) that employers can elect to treat certain qualified student loan payments made by participants as elective deferrals for purposes of matching contributions. Participants must annually certify that the loan payments are for debt incurred to fund their higher education.

Optional Roth Treatment of Employer Contributions. Employers now have flexibility (at their employees' election) to make matching contributions on either a Roth or pre-tax basis. Employer contributions designated Roth contributions will be included in the participant's income in the year contributed and must be 100 percent vested when contributed.

Age 50 Catch-Ups Must be Roth Contributions for High Earners. Participants who earn more than $145,000 per year now must make all their catch-up contributions after December 31, 2023, on a Roth basis.

Larger Catch-Ups for Participants Aged 60 to 63. The normal age 50 catch-up limit is increased to the greater of $10,000 or 150 percent of the regular catch-up in 2025 for participants who attain at least age 60, but not age 64, by the end of the current tax year.

III. Changes to Required Minimum Distributions, Employer-Forced Distributions, and Hardships

Increase in Required Beginning Date. As of January 1, 2023, the age by which participants must start taking required minimum distributions (RMD) is 73, and that will increase to 75 as of January 1, 2033.

RMDs to Cease for Roth Accounts. Roth accounts in employer defined contribution plans will no longer be required to make distributions to a participant prior to their death, beginning January 1, 2024. However, for Roth accounts that related to tax years before January 1, 2024, the pre-death RMD must still be paid (e.g. a 2023 RMD must be paid by April 1, 2024).

Change in Excise Tax Rate for Failure to Take RMD. The penalty for failing to take an RMD has dropped from 50 percent of the amount not distributed to 25 percent of the difference between the amount actually distributed (if any) and the amount required to be distributed. That penalty drops to 10 percent of the difference if the failure is "generally" corrected within two years of the failure.

Spousal Election to be Treated as Employee for RMD Purposes. Beginning January 1, 2024, another change for RMDs is for surviving spouses to be able to elect to be treated as the deceased employee for purposes of the required minimum distribution rules. This capability will generally allow distributions to be commenced later and synchronizes with the current rule under IRA accounts.

Increase in Involuntary Cashout Limit. Employers historically have been able to require participants to take distributions, without their consent, when their accounts are worth $5,000 or less. Starting January 1, 2024, that involuntary cashout limit increases to $7,000.

Hardship Self-Certification. When retirement plan participants make hardship withdrawals, they historically have required investigation by the plan to verify the claimed hardships. Now, however, plans are allowed to rely on the employees' self-certification that they are experiencing hardships for such withdrawals.

IV. Updates to Early Distributions

One penalty that always threatens early distribution is Section 72(t) of the Internal Revenue Code, which imposes a 10 percent penalty on early distributions from retirement plan accounts unless an exception applies. SECURE 2.0 comes with a host of new exceptions:

- Emergency Expense Exception. Participants can withdraw up to $1,000 for certain emergency expenses without repaying it, though they can opt to repay it in the three years following the withdrawal. Participants may only withdraw up to $1,000 annually under this provision, and only if they do not have an outstanding balance from a prior withdrawal. Participants will self-certify their own eligibility.

- Domestic Abuse Exception. Domestic abuse victims may withdraw the lesser of $10,000 or 50 percent of their account balances, and may repay the money within three years to receive a tax refund. The distribution must be made within one year of the event which makes them a victim of domestic abuse by a spouse or domestic partner and the participant will self-certify their own eligibility.

- Terminal Illness Exception. Participants with terminal illnesses (defined as having a physician certification that death is likely within 84 months) may withdraw money from their accounts. There is no limit on the number of withdrawals that may be made under this exception and the distribution can be repaid within three years to receive a tax refund.

- Distributions for Federally Declared Disasters. Participants affected by federally declared disasters may withdraw up to $22,000 from their employer retirement plan, and may elect to repay withdrawn amounts to potentially receive a tax refund—otherwise, they are included in gross income over a three-year period. Additionally, employers may allow for other, larger plan loans and longer repayment periods for those affected individuals.

- Long-Term Care Insurance Contract Exception. Beginning December 30, 2025, if a participant purchases a long-term care insurance contract, the plan may distribute up to $2,500 per year toward the premiums of the contract, provided the coverage is considered high quality under SECURE 2.0.

Caveat to Qualified Birth and Adoption Exception. SECURE 2.0 corrects what Congress viewed as an error in SECURE 1.0, under which employees could take early distributions to cover qualified birth or adoption expenses. Under SECURE 2.0, those prior distributions must be repaid within three years of the date of the original distribution to avoid the 10 percent excise tax.

V. Special Changes for 403(b) Plans

All of the changes discussed in this alert also apply to 403(b) plans, though some only apply to 403(b) plans to which ERISA applies—the chart at the bottom clarifies which provisions only apply if ERISA governs. There are two special changes that only apply to 403(b) plans:

- 403(b)(7) custodial account plans may now invest in collective investment trusts; and

- Starting January 1, 2024, the rules for hardship withdrawals from 403(b) plans will match the rules for 401(k) plans (previously qualified nonelective contributions, qualified matching contributions and earnings on those contributions were not eligible for withdrawal as a hardship).

VI. Broadened Ability to Self-Correct Errors

Perhaps one of the more favorable changes for plan sponsors under SECURE 2.0 are certain upgrades to the Employee Plans Compliance Resolution System (EPCRS). The Self Correction Program (SCP) under EPCRS historically has had some practical limitations, and employers had to follow strict timelines to make use of it. SECURE 2.0 is expected to allow employers to self-correct numerous additional types of errors at any time, provided (1) they do so in a timely fashion after discovering the error, and (2) the error was not otherwise discovered during an audit before the employer started taking steps to self-correct. With this said, plan sponsors still cannot use SCP for correcting egregious failures or addressing issues involving diversion or misuse of plan assets or abusive tax avoidance transactions.

VII. Miscellaneous

The following changes do not fit neatly into one of the categories described above, but nonetheless may be worth noting and exploring for certain employers:

- Lost and Found Program. Given the challenges many employers face with locating missing participants, SECURE 2.0 has tasked the Department of Labor (DOL) with creating an online and searchable database about retirement plans and their benefits. Plan administrators will have to provide the DOL with information about current and former participants (as dictated in future regulations) so that the database can be constructed. Participants with "lost" benefits will ultimately be able to search the database for purposes of claiming their benefits.

- Emergency Savings Account Feature. Employers can now allow non-highly compensated employees (i.e., employees earning $145,000 or less per year for 2023) to make Roth-like contributions to emergency savings accounts tied to their retirement plan accounts. Such contributions would need to be included when determining matching contributions due to the participant.

- Participant Overpayment Recoveries. If an ERISA retirement plan overpays a retiree by mistake, the plan fiduciaries may elect not to chase down the overpayment without breaching their fiduciary duties. But if they do elect to try recovering the overpayment, new limits and restrictions apply, such as (i) not seeking an interest charge, (ii) not threatening litigation, (iii) whether recoupment can be done pursuant to future payment reductions, and (iv) generally no recoupment if the overpayment is more than three years old.

- QDROs from Tribal Governments. SECURE 2.0 recognizes that domestic relations orders issued by Indian tribal governments can now be "qualified domestic relations orders."

As originally stated, this alert is intended to briefly highlight the provisions we view as more readily of interest to our client base. With that said, SECURE 2.0 has a multitude of additional provisions that clearly impact retirement plans that are not discussed here, including but not limited to (i) Saver's Credit, (ii) financial incentives to employees for making contribution to plans, (iii) removal of RMD barriers for annuities, (iv) Qualifying Longevity Annuity Contracts, (v) Code Section 403(b) multiple employer plans or pooled employer plans (PEP), (vi) PEP rules generally, (vii) rules pertaining to governmental Code Section 457(b) plans, (viii) changes to Simplified Employee Pension and SIMPLE IRA plans, (ix) auto portability prohibited transaction exemption, (x) changes impacting IRAs, and (xi) changes impacting defined benefit pension plans. Although each of these changes is important in their own right, they do not have the same broad applicability as the provisions discussed herein. If you would like more information regarding any of the provisions included in SECURE 2.0, please reach out to the authors or your regular Akerman attorney contact.

VIII. Plan Amendment Dates

Plan documents will need to be updated to comply with SECURE 2.0 and adopt any necessary amendments as follows: (i) non-governmental plans have until the last day of the first plan year starting after January 1, 2025, and (ii) governmental plans have until the last day of the first plan year starting after January 1, 2027. Notwithstanding this, the plan must be operated in accordance with such amendments as of the effective date of the SECURE 2.0 requirements or the amendment.

IX. Summary Chart