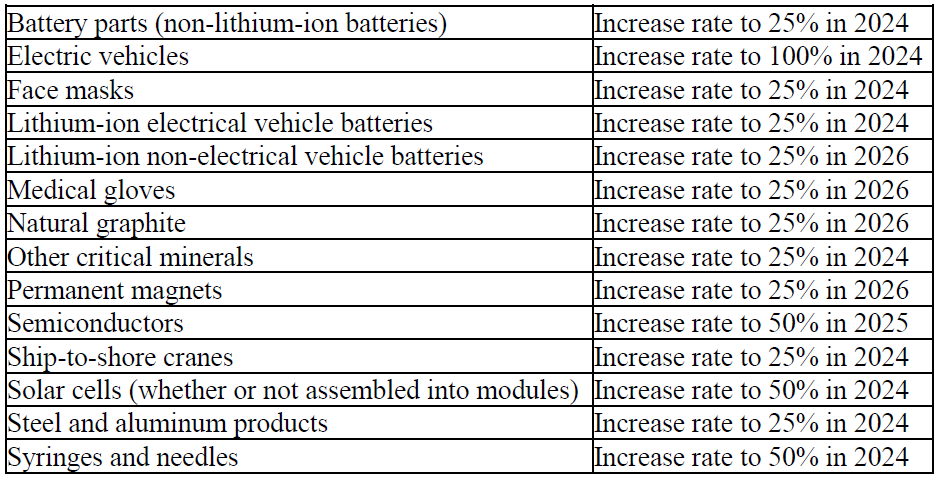

On Tuesday, May 14, 2024, in response to the U.S. Trade Representative’s (USTR) recommendations, the Biden Administration announced plans to add and increase Section 301 tariffs across strategic sectors such as steel and aluminum as well as semiconductors, electric vehicles, batteries, critical minerals, solar cells, ship-to-shore cranes, and medical products. Those changes are shown in the table below:

In particular, steel and aluminum products covered by the Section 301 tariffs will see a huge increase in tariffs as these Section 301 increases will stack on top of the Section 232 tariffs. Other products from China that are currently subject to Section 301 tariffs will remain unchanged.

In addition to the increase in Section 301 tariffs for the listed strategic sectors, the USTR also recommended in its “Four-Year Review of Actions Taken in the Section 301 Investigation: China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property and Innovation” the following actions: (1) establishing an exclusion process to target machinery used in domestic manufacturing and classified under Chapters 84 and 85 of the Harmonized Tariff Schedule of the United States (HTSUS), including solar manufacturing equipment; (2) increasing funds to U.S. Customs and Border Protection for greater enforcement of Section 301 actions; (3) increasing collaboration between private companies and government authorities to combat state-sponsored technology theft; and (4) continuing assessments to support the diversification of supply chains to enhance supply chain resilience. The exclusions for the machinery under chapters 84 and 85 of the HTSUS are found in appendix K of the USTR’s report (page 173).

Tuesday’s announcements did not specify the effective dates for these changes. In addition, no further details were released as to which specific products in these strategic sectors will be impacted. Nor did the announcement address the Section 301 exclusion requests that are currently set to expire on May 31, 2024.

Further details are expected to be released next week when the USTR will publish in the Federal Register procedures for interested parties to comment on the proposed increases in Section 301 tariffs and the exclusion process.

If you have any questions on how these changes to the Section 301 tariffs may affect your business, please contact one of the listed attorneys.