In December, we noted the added complexity due to the definitions of accelerated filer and large accelerated filer remaining unchanged when the Securities and Exchange Commission (the “Commission”) adopted amendments to raise the thresholds in the smaller reporting company definition. Well, the gray area just became a bit less gray. On March 12, 2020, the Commission adopted amendments to the accelerated filer and large accelerated filer definitions to more appropriately tailor the types of issuers that are included in the definitions.

When effective, the amendments will:

- Exclude from the accelerated and large accelerated filer definitions an issuer that is eligible to be a smaller reporting company and had annual revenues of less than $100 million in the most recent fiscal year for which audited financial statements are available;

- Exclude business development companies from the accelerated and large accelerated filer definitions in analogous circumstances;

- Increase the transition thresholds for an accelerated and a large accelerated filer becoming a non-accelerated filer from $50 million to $60 million and for exiting large accelerated filer status from $500 million to $560 million;

- Add a revenue test to the transition thresholds for exiting both accelerated and large accelerated filer status; and

- Add a check box to the cover pages of annual reports on Forms 10-K, 20-F, and 40-F to indicate whether an internal controls over financial reporting auditor attestation is included in the filing.

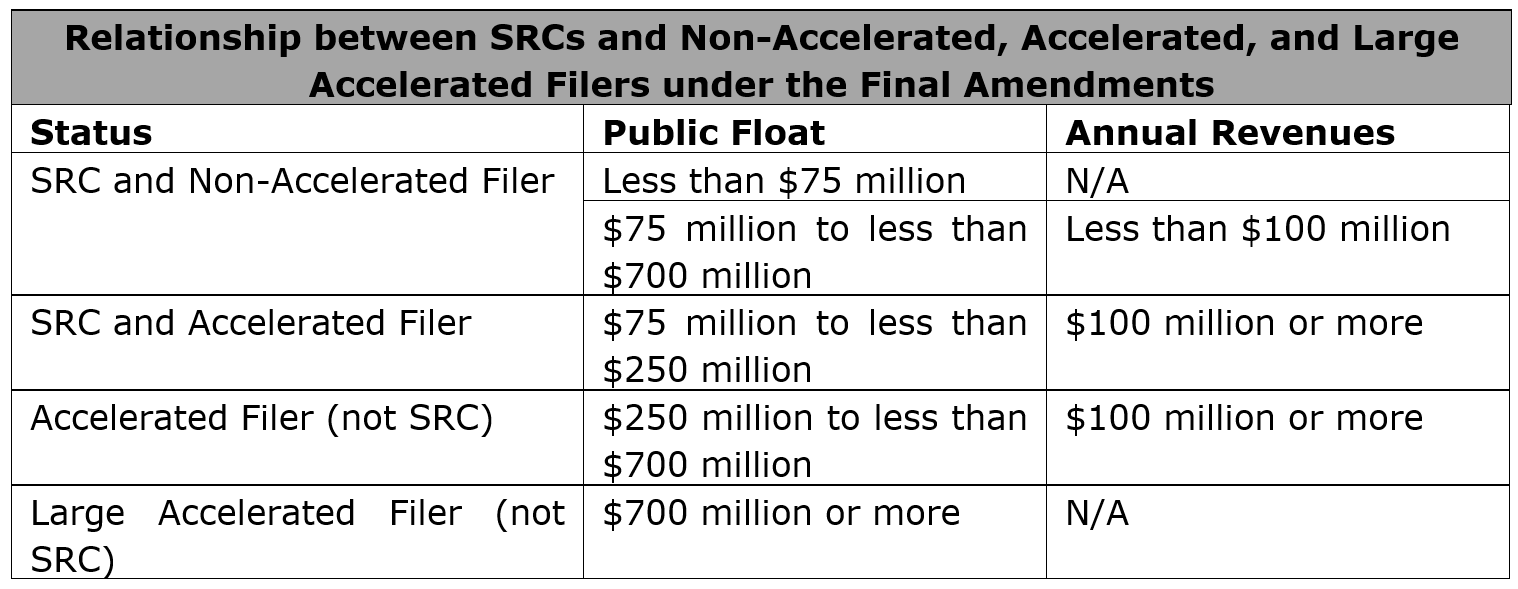

The table below from the Final Rule summarizes how the definitions of Non-Accelerated Filer, Accelerated Filer, Large Accelerated Filer and Smaller Reporting Company will fit together: