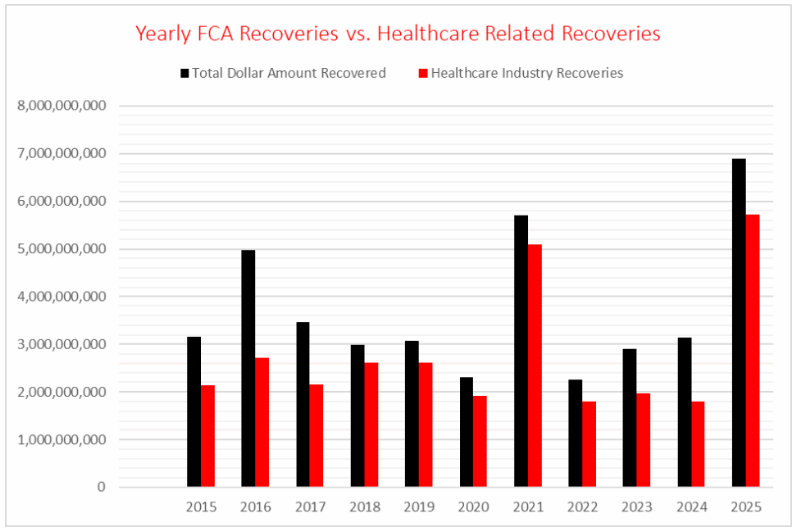

The Department of Justice (DOJ) released its annual False Claims Act (FCA) enforcement statistics on January 16, 2026. The DOJ announced a record level of recoveries from FCA resolutions in Fiscal Year (FY) 2025 (ending Sept. 30, 2025), which exceeded $6.8 billion. These statistics reflect the highest single-year dollar amount recovery on-record since the DOJ began reporting such statistics in 1987.

The record-setting $6.8 billion recovered in FY 2025 cleared the all-time high of $6.1 billion in recoveries set in FY 2014 and is more than double the dollar amounts the DOJ has recovered in recent years. Recoveries in FY 2021 reached $5.7 billion but dipped in FY 2022 ($2.2 billion) and saw only a modest increase in FY 2023 ($2.8 billion) and FY 2024 ($3.1 billion).

Healthcare Comprised Record $5.7 Billion in Recoveries

The DOJ also set a record with the recovery of more than $5.7 billion from the healthcare industry, comprising more than 83% of the total for FY 2025. Healthcare regularly represents the majority of FCA recoveries, accounting for more than 70% ($60 billion) of the $85 billion the DOJ has recovered under the FCA since 1987. This year’s figures exceed the average and show markedly more concentration of healthcare recoveries than the prior two years (68% in FY 2023 and 58% in FY 2024). Over the last decade, with the exception of 2021, no year saw a greater concentration of FCA healthcare enforcement (as measured against the whole of FCA enforcement) than 2025.

Notably, two large trial verdicts related to the pharmaceutical industry made up more than 44% of the overall healthcare-related recoveries, or approximately $2.5 billion (for $1.6 billion, and over $948 million respectively). Although large recoveries from successful verdicts at trial can typically be explained by treble damages, the per-claim penalties in these two cases were remarkably high.

Department of Defense Recoveries

The DOJ also set a second-place record for recoveries involving FCA enforcement of Department of Defense (DOD) contracts. The $633 million in recoveries — approximately 9.2% of FY 2025 recoveries — was just $7 million shy of the FY 2006 high point ($640 million) but represents a more than 550% increase over DOD-related recoveries in FY 2024 ($98 million). Except for FY 2023 ($556 million), FCA enforcement of DOD contracts had not risen beyond $300 million since FY 2009 ($438 million).

Cybersecurity, Civil Rights Fraud, Tariff/Customs Avoidance, and Pandemic Fraud

Matters outside of the healthcare and defense industries accounted for the remaining $532 million, or 7.7% of total recoveries in FY 2025. More than $230 million of those receipts emanated from pandemic fraud cases related to the Paycheck Protection Program (PPP). The remaining recoveries came from areas the new administration identified for priority focus throughout 2025, including cybersecurity fraud ($52 million), civil rights fraud enforcement and scrutiny (discussed below), and enforcement of trade laws involving allegations of tariff and customs avoidance. (The DOJ did not announce specific recovery amounts for these last two categories.)

Matters Opened and Whistleblower Recoveries

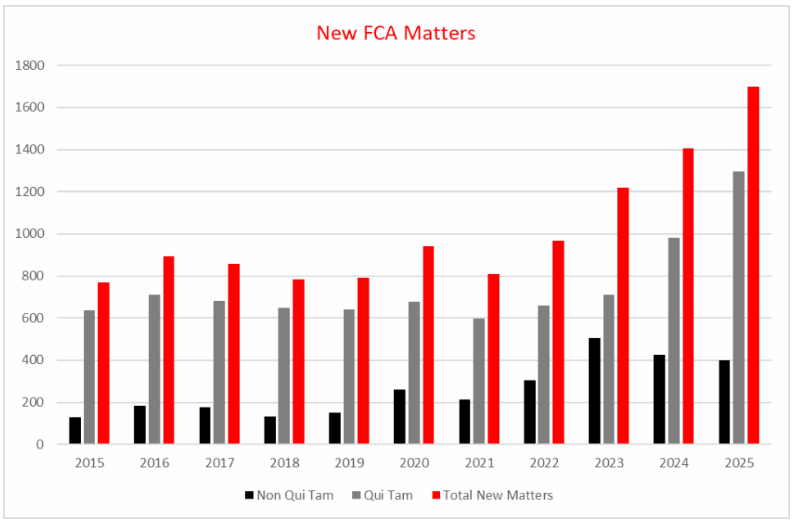

The overall number of new matters that the government and relator proxies opened in FY 2025 reached an all-time high of 1,698, topping FY 2024’s record of 1,405 new matters by approximately 21% (with the FY 2024 record itself topping the previous record from FY 2023 by 15%). Whistleblowers filed a record 1,297 of these lawsuits — the highest number in a fiscal year since the DOJ began keeping records in 1987 and a 32% increase over the FY 2024 high (980 matters brought by whistleblowers). The DOJ opened the remaining 401 new matters, representing a modest decrease from FY 2023 (506) and FY 2024 (425) in matters the DOJ brought without whistleblowers.

Overall, FY 2025 resolutions of qui tam lawsuits, whether or not the government intervened, yielded more than $5.3 billion — over 77% of total FCA recoveries.

Regarding healthcare matters, the DOJ brought 183 non-qui tam cases, compared with 87 in FY 2024 — representing a 110% increase. Healthcare whistleblowers also brought more cases, 458 as compared to 370 in FY 2024. Overall, whistleblowers received over $330 million in payouts, with more than $262 million going to whistleblowers in healthcare matters. Since the 1986 Amendments, whistleblowers have received more than $7.6 billion from healthcare FCA cases.

FCA Enforcement Trends in Healthcare

In addition to the DOJ’s years-long emphasis on allegations of billing for unnecessary healthcare services, substandard care, and improper billing, the DOJ’s Fact Sheet explicitly stated that its healthcare enforcement efforts focused on “three major areas”: Managed Care, Prescription Drugs, and Medically Unnecessary Care.

Unnecessary Healthcare Services and Substandard Care

The DOJ continued its perennial focus on fraud through the provision of unnecessary or substandard healthcare. For example, the DOJ highlighted a $45 million settlement with a specialty wound care provider related to allegations of overbilling and providing medically unnecessary services. Akerman’s healthcare team has closely monitored the wound care and skin substitute space following the DOJ’s announcement of a national focus on the industry in June 2025 and ensuing developments and ramifications for operators in the space.

A $10.25 million settlement resolved the government’s allegations that a hospital incentivized inpatient admissions with financial bonuses to contracted hospitalists and emergency department physicians, resulting in medically unnecessary inpatient hospital admissions where observation status or outpatient care was appropriate.

The DOJ also placed a focus on substandard care provided in nursing homes, including a $3.61 million settlement involving three affiliated nursing homes that the government alleged failed to follow appropriate infection control protocols and staffing levels. The government further alleged that one of the affiliated nursing homes was a “dirty, pest-infected building…[that] gave its residents unnecessary medications, subjected residents to verbal abuse, and failed to safeguard their possessions.”

The DOJ also intervened in a lawsuit against the current and former owners and operators of four nursing homes alleging that that the nursing homes, among other things, provided grossly substandard skilled nursing facility care, including substandard wound care, and failed to adequately assist residents with eating.

Medicare Advantage Enforcement

As noted in our FY 2024 Year in Review, last fiscal year saw an uptick in enforcement related to Managed Care, or the Medicare Advantage (Medicare Part C) program. That trend continued this year and included two major settlements with providers, including a $98 million settlement involving allegations of unsupported and invalid diagnosis codes added retroactively and a $62 million settlement involving allegations of false diagnosis codes submitted for conditions Medicare Advantage patients did not have. The government also intervened in a qui tam lawsuitinvolving allegations that national insurers paid kickbacks to brokers for patient steering and brought a new lawsuit against a health plan that it alleges made false statements to a state Medicaid program and retained expansion funding due to be returned to the federal government. The DOJ also emphasized that it was in active long-running litigation against major health insurance companies for allegations they added improper diagnoses to increase reimbursement.

Prescription Drug-Related Enforcement

Pursuant to the Trump administration’s focus on prescription drug pricing, the DOJ obtained multiple nine-figure settlements and two successful judgments pertaining to prescription drugs. These include:

- A verdict against a long-term care pharmacy and its parent entity for more than $948 million in total penalties that involved liability for dispensing drugs without valid prescriptions to residents of assisted living and other residential long-term care facilities.

- A $450 million settlement with a major generic drug manufacturer involving allegations the company (i) paid copays for Medicare patients while steadily raising the drug’s price and (ii) conspired in a price fixing scheme with other manufacturers of generic drugs.

- A $176 million settlement (plus $25 million to various states) that also included an admission and acceptance of responsibility for certain alleged conduct related to a biopharmaceutical company’s honoraria payments, meals, and travel expenses to high-volume prescribers of its drugs.

FCA enforcement in the prescription drug space is likely to be a growing area of focus for the DOJ under the current administration.

Other Key FCA Takeaways From FY 2025

DEI Enforcement Agenda

On May 19, 2025, building on the January 2025 Executive Order 14173 (“Ending Illegal Discrimination and Restoring Merit-Based Opportunity”), the DOJ established a Civil Rights Fraud Initiative focused on utilizing the FCA to investigate and pursue claims against institutions and government contractors who “knowingly violate federal civil rights laws.” The accompanying memorandum (May 19 Memorandum) from the Deputy Attorney General signaled the DOJ’s intent to enforce federal civil rights laws through “vigorous enforcement of the False Claims Act,” describing the law as the DOJ’s “primary weapon” in enforcement against fraud, waste, and abuse.

The May 19 Memorandum contends that the FCA is implicated “whenever federal-funding recipients or contractors certify compliance with civil rights laws while knowingly engaging in racist preferences, mandates, policies, programs, and activities, including through diversity, equity, and inclusion (DEI) programs that assign benefits or burdens on race, ethnicity, or national origin.” The May 19 Memorandum also states that the DOJ’s Civil Fraud Section and Civil Rights Division, as well as the Criminal Division and other federal agencies, including the Department of Health and Human Services, will coordinate enforcement of alleged violations.

Per Executive Order 14173, heads of federal agencies are directed to include in every contract or grant award a “term requiring such counterparty or recipient to certify that it does not operate any programs promoting DEI, which violate any applicable Federal anti-discrimination laws.” The civil rights fraud risk for entities doing business with the federal government thus involves a false certification theory of FCA liability whereby an entity is liable for falsely certifying its compliance with federal civil rights law when it arguably was not compliant.

While the May 19 Memorandum and related press release highlighted antisemitism on college and university campuses — major recipients of federal funds — as one enforcement area, other sectors are also being scrutinized: The Wall Street Journal reported in December 2025 that the DOJ has leveraged Civil Investigative Demands and launched investigations into the hiring and promotion practices at major U.S. companies that contract with the federal government across industries.

Proactive review and consultation with legal counsel is recommended for institutions and entities accepting funds from the federal government irrespective of form (e.g., payment under government contracts, reimbursements, grants, etc.). Status-quo compliance practices, policies, and procedures, even if well-intentioned, will need to be examined by legal counsel before DOJ attorneys scrutinize them, particularly given that the current administration’s interpretation of federal civil rights law differs from previous administrations.

Qui Tam Constitutionality

As we discussed in our FY 2024 Year in Review, Middle District of Florida Judge Kathryn Kimball Mizelle’s opinion in U.S. ex rel. Zafirov v. Florida Medical Associates, LLC, et al. was the first case to hold that the qui tam provision of the federal FCA violates the Appointments Clause of the Constitution. Judge Mizelle followed up by holding the same in a separate case in May 2025.

Zafirov is on appeal before the Eleventh Circuit, where oral arguments were held on December 12, 2025. (See our blog about that argument here.) The qui tam constitutionality question has also been briefed before the Third Circuit, while an interlocutory appeal presented to the Sixth Circuit was denied on January 9, 2026. Judges on the Fifth Circuit have also signaled their interest in the question in two separate cases despite that Circuit’s rejection of a previous constitutional challenge to the qui tam provisions two decades ago.

Akerman is closely following this issue. An ultimate invalidation of the qui tam provision on constitutional grounds would represent a monumental change in the landscape of fraud, waste, and abuse enforcement nationwide.

DOJ FCA Cooperation Credits

In our FY 2023 and FY 2024 Year in Review blogs, we noted that the DOJ had begun (for the first time in FY 2023) acknowledging cooperation credits provided to defendants that are cooperative in FCA investigations. That trend continued this year, with the DOJ noting that cooperative measures in FY 2025 included “self-disclosures, assistance with the determination of government losses, disclosures of internal investigations and facts not known to the government, and remedial measures such as implementing compliance program enhancements or terminating or separating culpable employees.”

Division of National Fraud Enforcement

In an unprecedented move on January 8, 2026, the Trump administration announced a new Division for National Fraud Enforcement within the DOJ that will be led by an assistant attorney general who operates directly out of the White House and reports directly to the president and vice president. The announcement’s accompanying Fact Sheet places a current focus on benefits-related fraud in Minnesota. While the structure of this new division leaves many questions unanswered, entities operating in the healthcare sector, and particularly the healthcare benefits and assistance programs space, should take a proactive approach to their compliance programs. Akerman’s attorneys are monitoring these developments closely.

Conclusion

FY 2025 set records in overall and healthcare-specific FCA recoveries and saw the DOJ reaching out to use the FCA for new enforcement priorities. FY 2026 will continue to see the development of ground-shifting litigation involving the constitutionality of the FCA’s whistleblower provisions. Akerman will continue to closely monitor these developments and other trends in FCA enforcement throughout the year.

Every organization operating within the American healthcare system should be acutely aware that it is among the most heavily regulated industries in the world. Akerman has a specialized team of attorneys dedicated to advising and guiding clients with healthcare compliance as well as FCA, Anti-Kickback, and Stark Law investigations and litigation.