In this issue

- Terminating Hotel Management Contracts During Periods of High Inflation

- Updates on SB 264 – Florida Law Restricting Persons From Foreign Countries of Concern From Owning, Having a Controlling Interest in, or Acquiring Certain Real Estate, Including Hotels and Condominium Hotel Units

- Getting Junked? FTC Focuses on Unfair and Deceptive Resort Fees

- Hotel Franchise Agreements Can’t Be Negotiated. Is That True?

Terminating Hotel Management Contracts During Periods of High Inflation

![]() KEY TAKE

KEY TAKE

Hotel owners considering terminating their long-term management contracts should be aware of the role high interest rates and inflation can play in the calculation of wrongful termination damages.

The significant and sustained increase in interests rates coupled with high inflation have caused uncertainty throughout the economy, including the hospitality industry. While a recent survey of hotel asset managers spreads hope that revenue per available room (RevPAR) for U.S.-based hotels will return to 2019 levels by 2025, hotel owners still face significant headwinds resulting from the COVID-19 pandemic, high periods of inflation, and sustained increases in interest rates.

Rates of high inflation and interest rates present myriad challenges for hotel owners. While much has been written about high inflation and interest rates making credit difficult to access and reducing hotel owners’ ability to leverage their current assets, high inflation also presents other pitfalls that may be less apparent to hotel owners. This includes the decision to, and ultimately the potential cost of, terminating long-term management contracts.

Read More

Updates on SB 264 – Florida Law Restricting Persons From Foreign Countries of Concern From Owning, Having a Controlling Interest in, or Acquiring Certain Real Estate, Including Hotels and Condominium Hotel Units

![]() KEY TAKE

KEY TAKE

New restrictions on land ownership in Florida by non-U.S. nationals is being challenged in court and pending resolution.

Owners, purchasers, and sellers of real estate located in Florida, including hotels and condominium hotel units, should be aware of recent legislation and pending court challenges affecting the implementation of such legislation.

The U.S. Court of Appeals for the Eleventh Circuit heard oral arguments on the merits of the Florida law restricting persons from “foreign countries of concern” from owning, having a controlling interest in, or acquiring an interest in certain Florida real property. The court of appeals halted the enforcement of Senate Bill 264, which introduced Chapter 692, Florida Statutes (the Bill), against two individual Chinese plaintiffs/appellants who were in the process of buying property in Florida when the Florida governor signed the Bill. The plaintiffs allege that SB 264 violates the Fourteenth Amendment’s Equal Protection and Due Process Clauses, the Supremacy Clause, and the Fair Housing Act.

Read More

Getting Junked? FTC Focuses on Unfair and Deceptive Resort Fees

![]() KEY TAKE

KEY TAKE

Hotels that have adopted charging a resort fee should be aware of the changing landscape regarding disclosures to guests.

On October 9, 2023, the Federal Trade Commission published a notice of proposed rulemaking entitled “Rule on Unfair or Deceptive Fees.” The proposed rule prohibits unfair or deceptive practices in the sale of goods or services, and, specifically, prohibits misrepresentations regarding the total cost of goods and services resulting from the failure to disclose fees and the nature and purpose of such fees, which they refer to as “junk fees.” The resort fees, which have become a typical part of the nightly rate of hotel accommodations, are included in these so-called junk fees that will be subject to any such final rule.

Read More

Hotel Franchise Agreements Can’t Be Negotiated. Is That True?

Jonathan Falik is the founder and chief executive officer of JF Capital Advisors. Mr. Falik leads the firm's hospitality business, which includes equity and debt placement, asset acquisitions and dispositions, portfolio transactions, JV structuring, asset management, management company and brand evaluation, and strategic and capital markets advisory services.

Jonathan Falik is the founder and chief executive officer of JF Capital Advisors. Mr. Falik leads the firm's hospitality business, which includes equity and debt placement, asset acquisitions and dispositions, portfolio transactions, JV structuring, asset management, management company and brand evaluation, and strategic and capital markets advisory services.

![]() KEY TAKE

KEY TAKE

Brands themselves and industry participants describe hotel franchise agreements as non-negotiable, though in reality, with experienced legal counsel and strategic/financial advisors, there are several key terms that can be negotiated.

Negotiation of Hotel Franchise Agreements

The form hotel franchise agreement comes directly from the brand’s lengthy Franchise Disclosure Document (FDD). Brands are reluctant to make changes to their form. With legal counsel, JF Capital has successfully negotiated over 125 hotel franchise agreements, and in each, we received concessions beyond the basic form. This was a function of knowing what is achievable in negotiations, and when those negotiations must take place. It is also driven by location, size, and profile of the hotel and the strategic and financial importance to the brand. We will examine some of the negotiated deal points that we regularly achieve, which differ from the franchise forms.

Read more

|

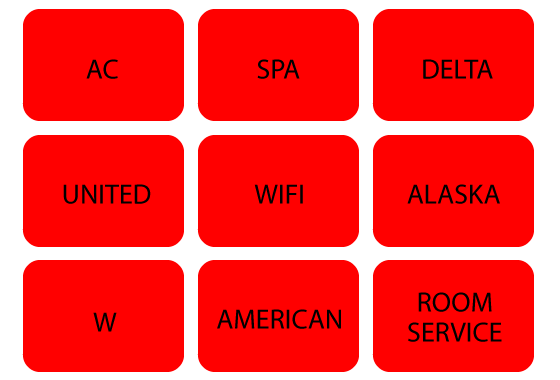

|

Trivia Question Common Elements Puzzle Please send your answers to [email protected] by Friday, August 9th. |