In this issue

- Ron Kornreich Named Co-Chair of Hospitality Sector Team to Advance Strategic Client Growth

- An Uncertain Environment: Managing Risks Associated with Tariff-Related Price Escalation in Hospitality Development

- Hotel Investment in an Era of Natural Hazards: Leveraging ASTM’s Property Resilience Assessment

- The Business Enterprise Approach (BEA) Theory Is Unsubstantiated

Ron Kornreich Named Co-Chair of Hospitality Sector Team to Advance Strategic Client Growth

Akerman is pleased to announce the elevation of partner Ron Kornreich to Co-Chair of its nationally recognized Hospitality Sector Team. Ron will serve alongside Co-Chair Andy Robins, succeeding Josh Bernstein, who will transition to Chair Emeritus while continuing his service on the firm’s Executive Committee. The move underscores Akerman’s commitment to delivering innovative, business-focused counsel to hospitality clients operating at the highest levels of the global marketplace.

Akerman is pleased to announce the elevation of partner Ron Kornreich to Co-Chair of its nationally recognized Hospitality Sector Team. Ron will serve alongside Co-Chair Andy Robins, succeeding Josh Bernstein, who will transition to Chair Emeritus while continuing his service on the firm’s Executive Committee. The move underscores Akerman’s commitment to delivering innovative, business-focused counsel to hospitality clients operating at the highest levels of the global marketplace.

Read More

An Uncertain Environment: Managing Risks Associated With Tariff-Related Price Escalation in Hospitality Development

![]() KEY TAKE

KEY TAKE

Unlike other sectors, hospitality projects are highly sensitive to material price swings due to design specificity, FF&E requirements, and strict brand standards, which make tariffs an outsized concern for project budgets and deadlines.

Trump-era tariffs continue to reshape pricing and procurement dynamics across all construction sectors, and hospitality is no exception. The reimplementation and expansion of tariffs under the second Trump administration have caused developers to rethink how construction contracts allocate and manage this renewed risk. For hospitality developers, where design specificity and material quality are paramount, this volatility can quickly derail project budgets and schedules. As Trump-era tariffs persist, their impact on hotel construction and renovation has only grown more pronounced. While domestic producers have ramped up output with increased production, this boost has not been enough to offset the loss or increased cost of imports. Consequently, hospitality owners are finding themselves confronted with ballooning costs, delayed deliveries, and contractors seeking change orders or time extensions due to tariff-related price spikes. Unlike broader commercial or institutional sectors, hospitality faces unique pressures from seasonal openings, FF&E-intensive build-outs, and brand-standard compliance, which magnify the effect of these escalating material costs. With procurement now more complex and costlier than ever, construction agreements must do more than react — they must anticipate. The good news: a proactive, hospitality-specific contract strategy can reduce uncertainty, protect the bottom line, and preserve brand integrity despite escalating material costs.

Read More

Hotel Investment in an Era of Natural Hazards: Leveraging ASTM’s Property Resilience Assessment

![]() KEY TAKE

KEY TAKE

Property Resilience Assessments are relatively new and likely to become a part of hotel acquisitions, development, and financing.

The ongoing and increasing threat of natural disasters throughout the country has expanded the costs and risks involved in acquiring, developing, and operating hotels as well as other investment properties. Depending upon the location of these assets, catastrophes may include damage from flooding, wildfires, coastal erosion, hurricanes, tornadoes, hail, the increasing frequency and severity of storms, and rising temperatures, among others. While developers, owners, lenders, and other market players may have a general understanding of these risks and how to mitigate their exposure to them, they often possess neither the data nor multidisciplinary approach to properly assess the exposure a particular property may have to these existing and increasing risks by virtue of its location, building materials, grading, or even how the property is developed out in terms of drainage, generators, etc.

Read More

The Business Enterprise Approach (BEA) Theory Is Unsubstantiated

Daniel H. Lesser is the Co-Founder, President, and CEO of LW Hospitality Advisors. He has more than forty years of specialized experience worldwide in hospitality related: real estate appraisals, economic feasibility evaluations, investment counseling, asset management, receivership, and transactional services of hotels, resorts, conference centers, casinos, mixed-use facilities, spa & wellness properties, and timeshare/fractional ownership properties.

Daniel H. Lesser is the Co-Founder, President, and CEO of LW Hospitality Advisors. He has more than forty years of specialized experience worldwide in hospitality related: real estate appraisals, economic feasibility evaluations, investment counseling, asset management, receivership, and transactional services of hotels, resorts, conference centers, casinos, mixed-use facilities, spa & wellness properties, and timeshare/fractional ownership properties.

Real estate taxes are one of the primary revenue sources used by municipalities to obtain funds for public expenditures such as parks, highways, interest on bonds, and other government services. Based on the concept that the tax burden should be distributed in proportion to the value of all properties within a taxing jurisdiction, a system of assessments is established by a local assessor. Theoretically, the assessed value placed on each parcel bears a relationship to its market value. Therefore, properties of equal market values should have similar assessments. Depending upon the taxing policy of a municipality, property taxes can be based on the value of only real property (i.e. real estate tax) and in many cases also on the value of personal property.

Read More

Upcoming and Recent Events

- Ron Kornreich and Josh Bernstein to Speak at the 2025 HOFTEL Americas Members’ Summit (September 30, 2025)

- Akerman Sponsors the 2025 Hotel & Lodging Legal Summit (October 16-17, 2025)

|

|

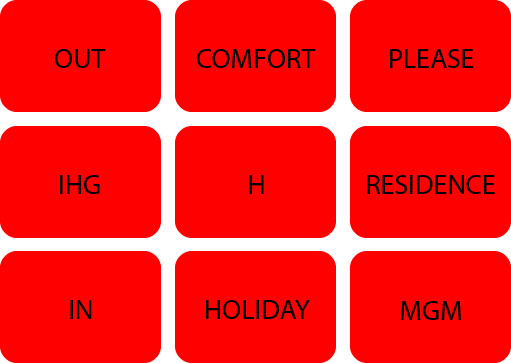

Common Elements Puzzle Please send your answers to [email protected] by Friday, October 3, 2025. Congratulations to the winners of last edition’s puzzle! The answers were (1) Fawlty Towers, White Lotus, Hotel Transylvania – Fictional Hotels; (2) Radisson Red, Rosewood, Hotel Indigo – Hotels with colors in their names; (3) Waldorf Astoria, Hotel Chelsea, The Plaza – Iconic New York City hotels. |