In this issue

- Hotel-Condominium Governance Litigation: Could IconBrickell Go National?

- The Importance of Termination Provisions in Franchise Agreements and License Agreements

- Will New Legislation Shift the Balance of Power in the Franchisor-Franchisee Relationship?

- Welcome, Joe Brasile!

- Q&A with Greig Taylor of AlixPartners

- Akerman at the AOHIS Conference in Madrid!

Hotel-Condominium Governance Litigation: Could IconBrickell Go National?

![]() KEY TAKE

KEY TAKE

The IconBrickell decision disrupted the Florida hotel-condominium market. Could the same thing happen in other jurisdictions?

In 2020, the Florida Third District Court of Appeal issued the IconBrickell decision that has had a profound effect on the way practitioners and developers think about the legal landscape of mixed-use properties throughout the state of Florida, particularly branded residential condominiums. In IconBrickell Condominium No. Three Association v. New Media Consulting, 310 So.3d 477 (Fla. 3d DCA 2020), the Florida appellate court held that the condominium declaration that governed the property rights of owners at the W Hotel in downtown Miami violated that Florida Condominium Act and needed to be reformed. Specifically, the court held that the designation of certain property components as “shared facilities” that were owned in fee simple by the hotel unit owner was a violation of the Florida Condominium Act, which requires those property rights to be held by all condominium unit owners as “common elements.”

Read More

The Importance of Termination Provisions in Franchise Agreements and License Agreements

![]() KEY TAKE

KEY TAKE

Franchisees may be subject to injunctions for improper termination of franchise agreements.

Franchise agreements, which are often accompanied by license agreements, grant franchisees the right to use the franchisor's brand, including the franchisor's registered trademarks and system manuals needed to operate the brand. Franchisors are generally the primary drafter of their franchise and license agreements, which often tend to favor the franchisors. As a result, franchise and license agreements are usually one-sided and minimally negotiable.

Read More

Will New Legislation Shift the Balance of Power in the Franchisor-Franchisee Relationship?

![]() KEY TAKE

KEY TAKE

Keep an eye out for potential legislation that could rein in hotel franchisors.

Most hoteliers believe that franchisors have the upper hand in negotiating hotel franchise agreements. Some franchisors attempt a “take-it-or-leave-it” approach to negotiations. Many franchise agreements afford franchisors wide latitude in maintaining their franchise systems and give franchisors flexibility to modify their brand standards and system fees unilaterally.

Read More

Welcome, Joe Brasile!

Akerman proudly welcomes Joseph Brasile to our New York office as a partner in the Real Estate Practice Group and Hospitality Sector Team.

Akerman proudly welcomes Joseph Brasile to our New York office as a partner in the Real Estate Practice Group and Hospitality Sector Team.

Brasile focuses his practice on complex commercial real estate transactions for owners, developers, institutional and private lenders, borrowers, landlords, and tenants. He has broad real estate financing experience, including advising clients on permanent loans, acquisition loans, construction loans, and mezzanine loans. His work with distressed assets includes loan workouts, forbearance agreements, and deed-in-lieu of foreclosure agreements.

For owners and developers, Brasile has experience negotiating purchase and sale agreements, ground leases, sale leasebacks, office leases, retail leases, and the purchase and sale of air rights, among other matters. He also has comprehensive experience representing lenders, owners, developers, and tenants of all types of asset classes, including office buildings, development projects, hotels, and shopping centers.

Q&A with Greig Taylor of AlixPartners

Greig Taylor is a partner and managing director at AlixPartners with more than 20 years of experience in resolving disputes involving accounting, valuation, and economic damages.

Greig Taylor is a partner and managing director at AlixPartners with more than 20 years of experience in resolving disputes involving accounting, valuation, and economic damages.

Christopher Rubel is a partner at AlixPartners with more than 15 years of experience in the accounting and advisory industry, focusing on high-urgency litigation, valuation, and restructuring matters.

Sheng Bi is a Senior Vice President at AlixPartners specializing in complex damages and valuations.

Q: For those readers who are not familiar with your work, can you tell us a bit about what you do?

A: Of course. A lot of my work involves acting as a damages expert in high-end Hotel Management Agreement (HMA) termination disputes, especially involving claims for lost profits. In working as an expert, I have testified in numerous arbitrations, both international and domestic. Because many HMA termination disputes end up in arbitration and those decisions are not published, there isn’t a reliable database in terms of being able to look at how tribunals and courts determine these types of damages. This is why my team and I have begun the process of collecting damages awards for the purposes of analyzing trends, and we are planning on publishing those findings later this year.

Q: Could you provide us an overview of the sources and data you reviewed?

A: Absolutely. We reviewed a number of publicly available decisions published by U.S. state and federal courts, various U.S. and international arbitration institutions, and information in public databases, as well as anonymized information from non-public matters on which any of the research team served as an expert.

Q: What key trends or changes have you identified in the evolution of property management agreements that are relevant to understanding disputes in recent times?

A: HMAs were developed in the 1950s when large hotels operators expanded internationally. Based on the financial information reported in annual reports of public hotel operators, we have seen that franchise agreements have become the most prevalent form of contract in place for large brand operators for midscale and economy properties, while HMAs remain far more common amongst flagship luxury properties. Given the prevalence of HMAs remaining for upper upscale and luxury properties, these categories of hotels feature heavily in our analysis.

Q: Are there any recurring themes or patterns in the disputes that you have observed?

A: We have observed some common issues in disputes. The termination of HMAs tends to center around allegations of mismanagement by the manager resulting in poor financial performance, as well as shifts in the hotel owner’s strategy. The change of control of an operating property in connection with a bankruptcy or other financial restructuring is also a common issue encountered in HMA terminations.

Q: Moving into the realm of damages, what trends or variations have you observed in your research?

A: Among the decisions we reviewed, we have observed a wide spectrum of damages awards, ranging from around $2 million to $100 million, including prejudgment interest. Lost profit calculations are the most commonly used approach in HMA disputes to determine damages. When we broke the damages down to a per-key basis, we noted a range of about $300 to $2,900. Interestingly, damages per key for hotels located outside of the United States are generally lower than hotels within the United States.

Q: Can you discuss the typical duration of damages under the lost profits approach in HMA terminations?

A: Certainly. It turns out that extensions and renewal terms are key factors in determining the damages under the lost profits approach because they impact the duration of damages. Our case studies indicate that extensions or renewals were considered by the court or tribunal only if the HMAs could be extended unilaterally at the operator’s option.

Q: Which fee streams are commonly considered under the lost profits approach, and have you noticed any variations in their significance?

A: Typically, HMAs contain two types of management fees: base fees and incentive fees. Operators often charge other fees such as license fees and marketing fees, which were also considered in the damages calculation. The majority of damages awards granted in the cases we examined provided for base fees only. A low perceived probability of achieving specified financial benchmarks is the most common reason that incentive fees are excluded in assessed damages.

Q: Lastly, let’s talk about discount rates. How do they factor into lost profits calculations, and what trends have you identified in their application in HMA disputes?

A: A discount rate is the rate of return used to discount future lost profits back to their present value. Therefore, discount rates are crucial in the determination of the damages. We have observed that discount rates used in damage award calculations included adjustments for country risk, company size premium, and other specific risk factors. Notably, some courts and tribunals applied a higher discount rate to projected incentive fees than base fees. We found that discount rates for base fees seem to be within a relatively narrow range of about 10 to 14 percent.

Akerman at the AOHIS Conference in Madrid!

Akerman’s Hospitality Team had the pleasure of attending the prestigious Atlantic Ocean Hotel Investors' Summit (AOHIS) in Madrid, Spain! Co-Chair Joshua Bernstein and Partner Ron Kornreich networked and connected with attendees from across the hospitality universe — global hotel real estate investors, developers, franchisees, company owners and their families, and CEOs, among others.

Akerman’s Hospitality Team had the pleasure of attending the prestigious Atlantic Ocean Hotel Investors' Summit (AOHIS) in Madrid, Spain! Co-Chair Joshua Bernstein and Partner Ron Kornreich networked and connected with attendees from across the hospitality universe — global hotel real estate investors, developers, franchisees, company owners and their families, and CEOs, among others.

Josh spoke on a panel titled "The power of the management/franchise companies in contract negotiations has increased, is increasing, and ought to be diminished," which discussed current trends in hotel management and franchise agreements and whether brand negotiating power has increased.

Run "by owners for owners," AOHIS, presented by HOFTEL, is a high-level, owner-driven conference based around hotel real estate investors with a reach across the world. HOFTEL is the only global alliance of hospitality real estate investors specifically designed to represent the disparate owners of hotels and provide them with a voice as a distinct industry sector.

|

|

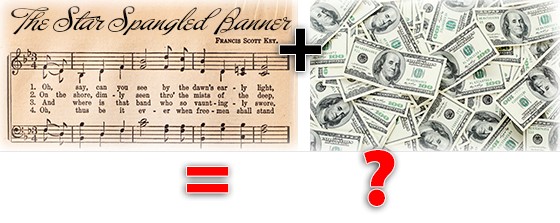

Trivia Question: Congratulations to the winners of last edition's trivia question! The answer to "Guess the Hospitality Term" was Competitive Set. Can you guess this edition's hospitality term? The first five readers who guess correctly will receive a special Akerman gift. Please send your answers to [email protected] by March 1st. |